Classic Chevrolet now has 32 Bolt EVs in stock and another 5 have been built and are in route to the dealership. I checked the state of Texas’ Chevy dealers to determine our major competitors. As it turns out, the nearest to our inventory level is a dealership in Austin, a hotbed of EV adoption. They have 7.

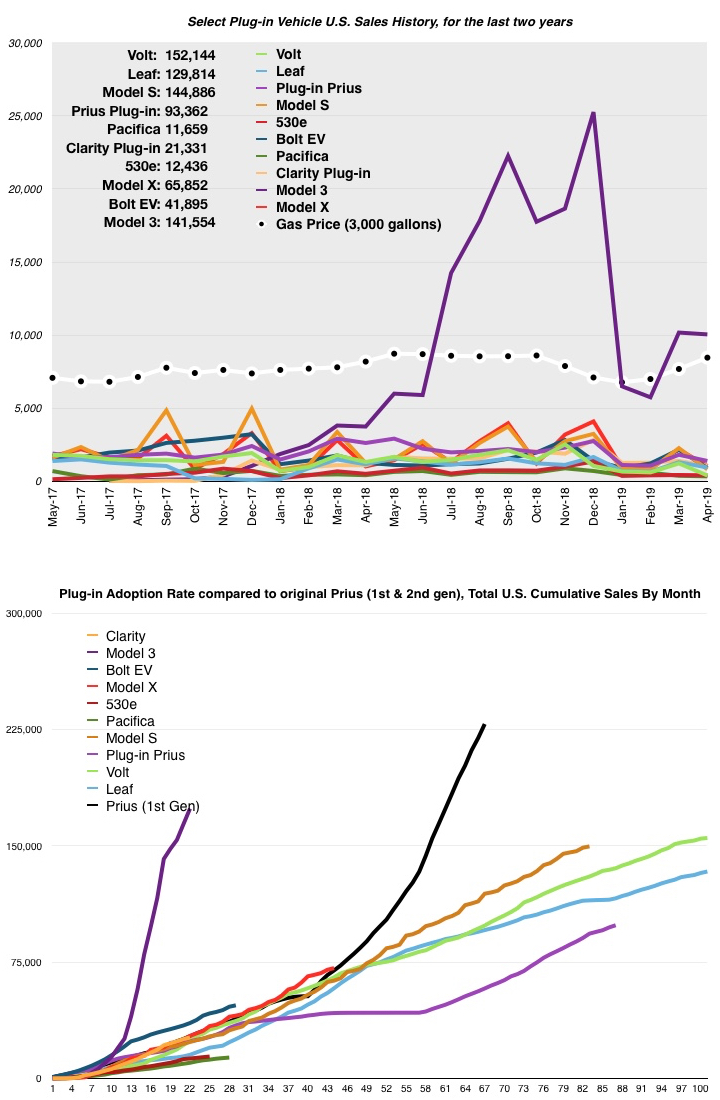

Now that we have April sales data on GM’s first month, after the income tax credit reduction for GM plug-in vehicles, we can possibly see the effect of that event on sales. In the chart below, the Tesla Model 3 had a steep dive in sales in January. January is the first month that Tesla’s EVs no longer qualified for the full $7,500 tax credit. In Georgia, EV sales plummeted, after the state incentive program ended. Based on those two prior examples, I fully expected GM’s sales volume would plummet, as well.

The result? Volt sales dropped from 1,230 in March to 405 in April, however, some of this drop may have been a result of three other issues: 1) the Volt has been discontinued, which may make some buyers skittish about its service future, 2) inventory levels are starting to become depleted as units sell and nothing is replacing them and 3) the last of Texas’ $2,500 plug-in vehicle rebates was issued in late March, giving me a perfect storm of incentives going away. The interesting thing is that GM increased cash incentives on Volt and Bolt EV, at least in my region, enough to offset the lost portion of the income tax credit. This incentive actually was better than the tax credit, since the buyer did not have to wait until next tax season to collect it and it is not dependent on the buyer having a great enough tax burden to get the entire tax credit. March’s new rebate was a reduction of 11% off MSRP for 2019s and 18% off 2018’s. Even the least expensive Volt (or Bolt EV, for that matter) would have the buyer realizing a reduction in price of at least $3,740 (at least $6,120 off 2018 Volts). However, there were no advertisements, that I saw, about these great incentives and the Volt plummeted 67% and the Bolt EV fell 58%.

Below, are the April 2019 sales figures, compared to the previous month. Their sales were all down, four of them, significantly down.

Below, are the April 2019 sales figures, compared to the previous month. Their sales were all down, four of them, significantly down.

- Chevy Volt: DOWN 67% (405 vs. 1,230) **estimated

- Chevy Bolt EV: DOWN 58% (910 vs. 2,166) **estimated

- Nissan Leaf: DOWN 28% (951 vs. 1,314)

- Plug-in Toyota Prius: DOWN 23% (1,399 vs. 1,820)

- Tesla Model S: DOWN 64% (825 vs. 2,275) **estimated

- Tesla Model X: DOWN 52% (1,050 vs. 2,175) **estimated

- BMW 530e: DOWN 5% (416 vs. 436)

- Plug-in Chrysler Pacifica: DOWN 8% (347 vs. 383)

- Honda Clarity BEV & PHEV: DOWN 24% (1,069 vs. 1,403)

- Tesla Model 3: DOWN 1% (10,050 vs. 10,175)

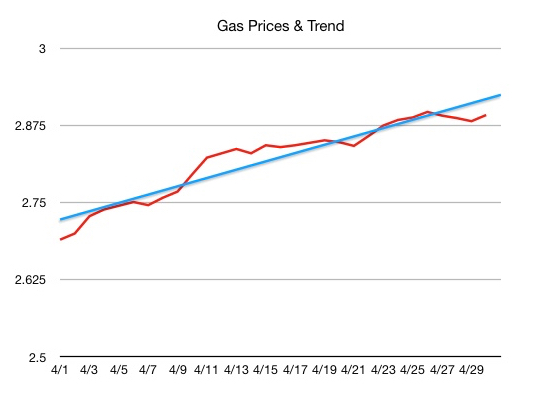

Gasoline prices rose steadily all month, continuing a four month trend. April gasoline prices started at $2.69 per gallon, and ended 20¢ above the price at which it started, ending at $2.89. My vehicle sales, in April 2019, were above average for April. In fact, this was my third-best April ever. The table to the left of the chart has cells highlighted in red, if my sales were below my historical average for the month and green, if above average. April continued a six month trend, in which my monthly sales have been above my historical average for that month. That was surprising, because traffic at area dealerships, including ours, was significantly down.

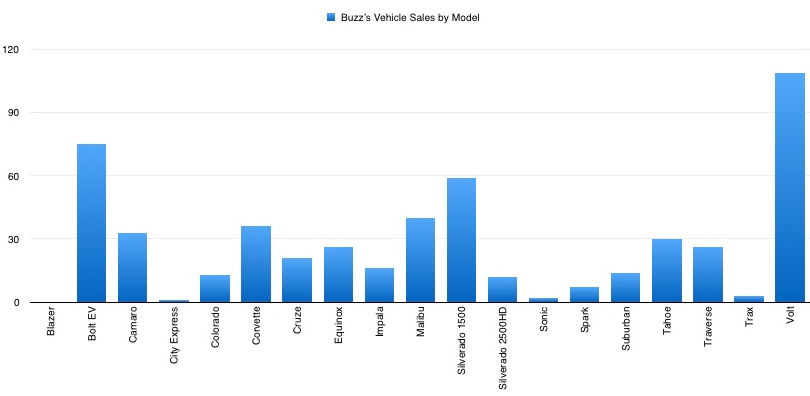

My vehicle sales, in April 2019, were above average for April. In fact, this was my third-best April ever. The table to the left of the chart has cells highlighted in red, if my sales were below my historical average for the month and green, if above average. April continued a six month trend, in which my monthly sales have been above my historical average for that month. That was surprising, because traffic at area dealerships, including ours, was significantly down. My seven April 2019 sales were comprised of two Bolt EVs, a Suburban, a Silverado, a Cruze, and two Malibus. Bolt EV and Volt have dominated my sales, over the last 5-1/2 years, but I only sold two plug-ins last month.

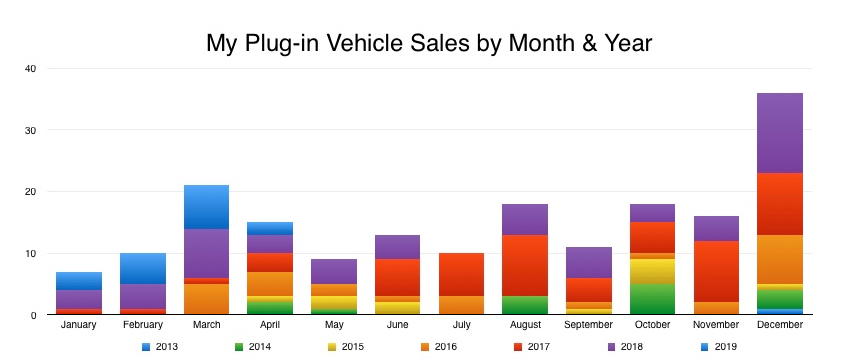

My seven April 2019 sales were comprised of two Bolt EVs, a Suburban, a Silverado, a Cruze, and two Malibus. Bolt EV and Volt have dominated my sales, over the last 5-1/2 years, but I only sold two plug-ins last month. You can see, in the chart below, that the thin blue bar for April is greatly reduced from January, February and March of this year.

You can see, in the chart below, that the thin blue bar for April is greatly reduced from January, February and March of this year.

To find the last time my plug-in sales were as low as last month, you’d have to go back to July 2018, when I didn’t sell a single plug-in vehicle. At that time, I had sold completely out of Bolt EVs and had only one Volt in stock. The last time I actually had sufficient inventory and sold less, was in May 2017! The chart below shows my plug-in sales volume for my entire career, in vehicle sales, beginning in October 2013 (left end) to last month (right end). Last month looks pretty puny. On an upbeat note, I am still getting inquiries about the Bolt EV.

To find the last time my plug-in sales were as low as last month, you’d have to go back to July 2018, when I didn’t sell a single plug-in vehicle. At that time, I had sold completely out of Bolt EVs and had only one Volt in stock. The last time I actually had sufficient inventory and sold less, was in May 2017! The chart below shows my plug-in sales volume for my entire career, in vehicle sales, beginning in October 2013 (left end) to last month (right end). Last month looks pretty puny. On an upbeat note, I am still getting inquiries about the Bolt EV.

Plug-in sales, compared to the same month a year ago, were mixed, with most dropping and only two increasing (one of those two, only slightly increasing):

- Chevy Volt: DOWN 69% (405 vs. 1,325)

- Chevy Bolt EV: DOWN 29% (910 vs. 1,275)

- Nissan Leaf: DOWN 19% (951 vs. 1,171)

- Plug-in Toyota Prius: DOWN 47% (1,399 vs. 2,626)

- Tesla Model S: DOWN 34% (825 vs. 1,250)

- Tesla Model X: UP 2% (1,050 vs. 1,025)

- BMW 530e: DOWN 20% (416 vs. 518)

- Plug-in Chrysler Pacifica: DOWN 18% (347 vs. 425)

- Honda Clarity BEV & PHEV: DOWN 3% (1,069 vs. 1,101)

- Tesla Model 3: UP 168% (10,050 vs. 3,750)

On a final note, a comment on Facebook asked me to comment on where I obtain my sales figures. I use several sources, including InsideEVs, GoodCarBadCar, CarSalesBase and hybridCars.

32 Bolts! Can you and your colleagues move that many? Dealerships don’t like cars sitting on the lot for more than a month or two, right?

Two more arrived Saturday, so we’re up to 34. Three more are on their way here. As for your question, only time will tell. GM stepped up and put great incentives on them, but the lack of advertising means that most people don’t know about the car and those that do, don’t know about the incentives. With that many on-site, I’ll eventually have them on the front row, facing the street, but for now the dealership is focused on clearing out the remaining 2018 pickups. The double whammy of being hit with the end of the Texas Rebate and the halving of the tax credit will be tough to handle, but this is my mission. In Georgia, when their state incentive program ended, plug-in vehicle sales PLUMMETED. SEVERELY. If it can be done, I’m going to be the man to do it in Texas.

Is Classic #1 in Bolt and Volt sales in Texas? (It must be.)

I’ve never seen the numbers for the dealerships around Austin. The public down there is much more aware and in favor of EVs. I’ll bet a larger percentage of their sales staff actively sells plug-in vehicles, where at Classic, I’m one of the few people that sell EVs. But…https://austineconetwork.com/that-time-i-tried-to-buy-an-electric-vehicle-and-no-one-would-sell-it-to-me/

Things are slow to change at the dealerships, even the ones in Austin. Good article.