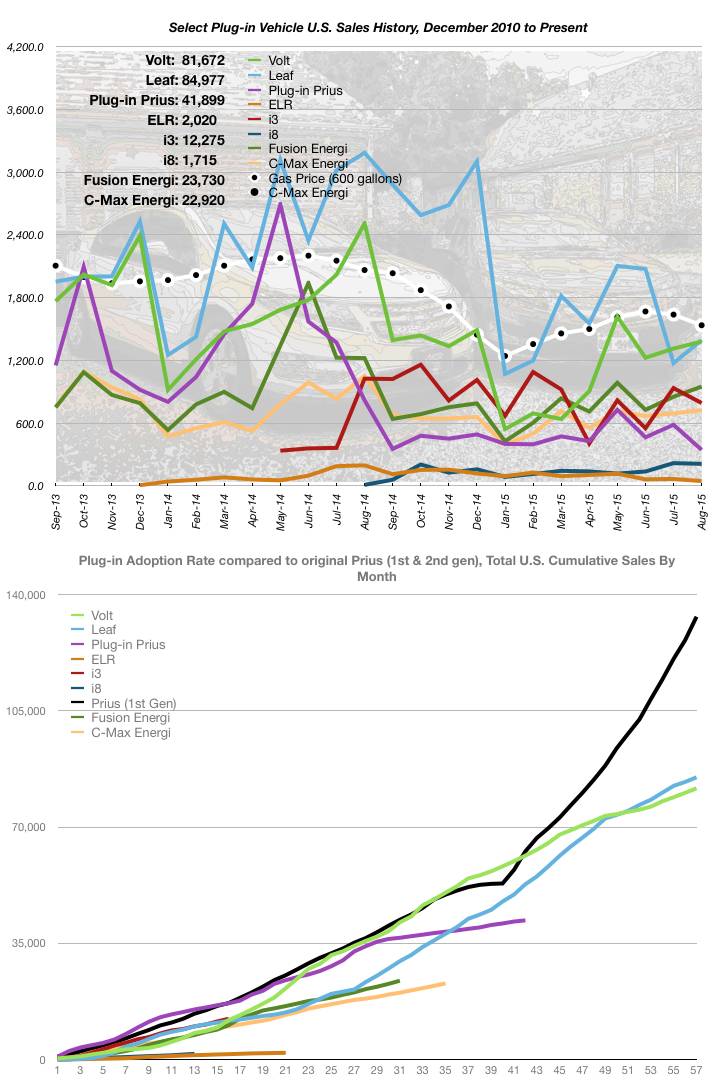

In August 2015, the plug-in market was a mixed bag:

- Chevy Volt: UP 5% (1,380 vs. 1,313)

- Nissan Leaf: UP 19% (1,394 vs. 1,174)

- Plug-in Toyota Prius: DOWN 41% (344 vs. 584)

- Cadillac ELR: DOWN 32% (45 vs. 66)

- BMW i3: DOWN 15% (792 vs. 935)

- BMW i8: DOWN 3% (210 vs. 217)

- Ford Fusion Energi: UP 11% (949 vs. 852)

- Ford C-Max Energi: UP 4% (723 vs. 693)

The price of gasoline started a precipitous drop in the first week of the month, followed by an increase during the 2nd week, back to a point slightly higher than at month start. Then the bottom fell out and the price of gasoline dropped to a low of $2.48 per gallon at month’s end and averaged $2.56 for the month. Although the Chevy Volt’s sales continued to rise for the second month in a row, it did not beat out the Nissan Leaf, as it did the previous month. My view from inside the dealership is that dealers, in low-demand areas especially, are dropping prices precipitously, to move the current model out, before the new one starts production later this month. The Nissan Leaf recovered partially, after dropping a whopping 43% in July, by increasing sales by 19% in August. What’s becoming a concern is the bottom chart. Compared to the original Prius, which I use as a new technology adoption success, the Volt and Leaf are trailing off in adoption. The original Prius did this just prior to the second generation Prius debut (lower chart months 36-39). Then, the roof blew off and people started buying Prius’ in droves, equalling the first 39 months’ sales in only 12 months. Perhaps the low price of gas is having some impact, but my experience in the dealership, is that people test driving Volts love them for their quality of ride, acceleration then economy. The widening gap, between the original Prius adoption curve and the Volt/Leaf’s adoption curves, causes me pause.

July’s sales figures show the Leaf regaining a little ground, for all-time sales since inception. The Leaf’s lead over the Volt has been trimmed to 3,305 units, a gain of 14 units. The Plug-in Prius has another bad month, dropping 41% from July’s numbers. The Cadillac, dropped as well, with an decrease of 32%. The BMW i3 dropped 15%from the previous month, which had been a significant increase over July. The BMW i8 also a minor drop of 3%. Ford’s numbers on the Fusion Energi and the C-Max Energi increased. The Fusion by 11% and the C-Max by 4%.

Sales, compared to the same month a year ago, are almost all down. Substantially. In this case, only one vehicle showed an increase. That one EV was the BMW i8, but the last month’s sales were being compared to the very first month of i8 availability in the U.S. For this reason, I don’t consider it to be an outlier, in the data trend. Next month will tell us more on the i8’s story…

- Chevy Volt: DOWN 45% (1,380 vs. 2,511)

- Nissan Leaf: DOWN 56% (1,394 vs. 3,186)

- Plug-in Toyota Prius: DOWN 58% (344 vs. 818)

- Cadillac ELR: DOWN 77% (45 vs. 196)

- BMW i3: DOWN 23% (792 vs. 1,025)

- BMW i8: UP 2,233% (210 vs. 9) *9 units in first month of availability

- Ford Fusion Energi: DOWN 22% (949 vs. 1,222)

- Ford C-Max Energi: DOWN 31% (723 vs. 1,050)

Great article, but the Volt sales of 72,270 units from Jan-Aug2015 are down only 9.33% over the same period in 2014 which saw 79,705 units sold. And Jan-Aug2015 numbers are UP 21.44% over the same period in 2013 which saw 59,512 units sold.

Not bad considering a phase-out year, but with the national roll-out the Gen2 Volt pushed out to Feb2017 it will be very interesting to see if somehow the MY2016’s allow the Volt hit the 2015 Year sales of 123,049 units. That would take 12,695 units average each month to hit the needed 50,779 units. 2014 sold 43,344 Volts sold in the last 4 months.Probably more realistic to hope for 100,00 Volts in 2015, which is 6,933 Volts per month. And that may be a problem with the remaining dealer inventory.

oops.. 2014 Year sales of 123,049 units…

I’m a bit confused by your figures. From January to August 2015, 8,315 Volts were sold in the U.S., not 72,270. Sales for the same period in 2014 were 13,146 unit, not 79,705. This represents a drop in sales of 37%, between those two time periods. 2014 total Volt sales were 18,805, so General Motors would need to sell 10,490 Volts by December 31st, in order to reach last year’s sales total. That’s 2,623 per month for the remaining 4 months of the year. There are six months in which the Volt’s sales were higher than this number (Aug 2012, Sept 2012, Oct 2012, Dec 2012, June 2013 and Aug 2013), so it is possible, if the 2016’s start arriving and the non-CARB states buyers turn to the existing inventory. Perhaps you were referencing total plug-in sales rather than Volt. Also, I am not tracking sales by model year, so the existing inventory of 2014/2015 Volts will count toward total sales, during the period when the 2016 Volt is available to the 11 CARB states. I expect the prior model years will be overshadowed by the 2016, in the areas where it is available, but I also expect General Motors to keep sweetening the deals to clear out those older models. I myself am considering a 2015, before year’s end, to get the income tax credit.