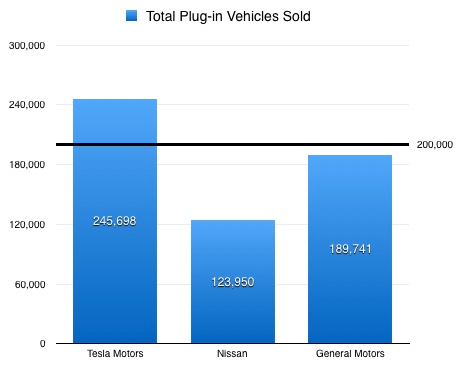

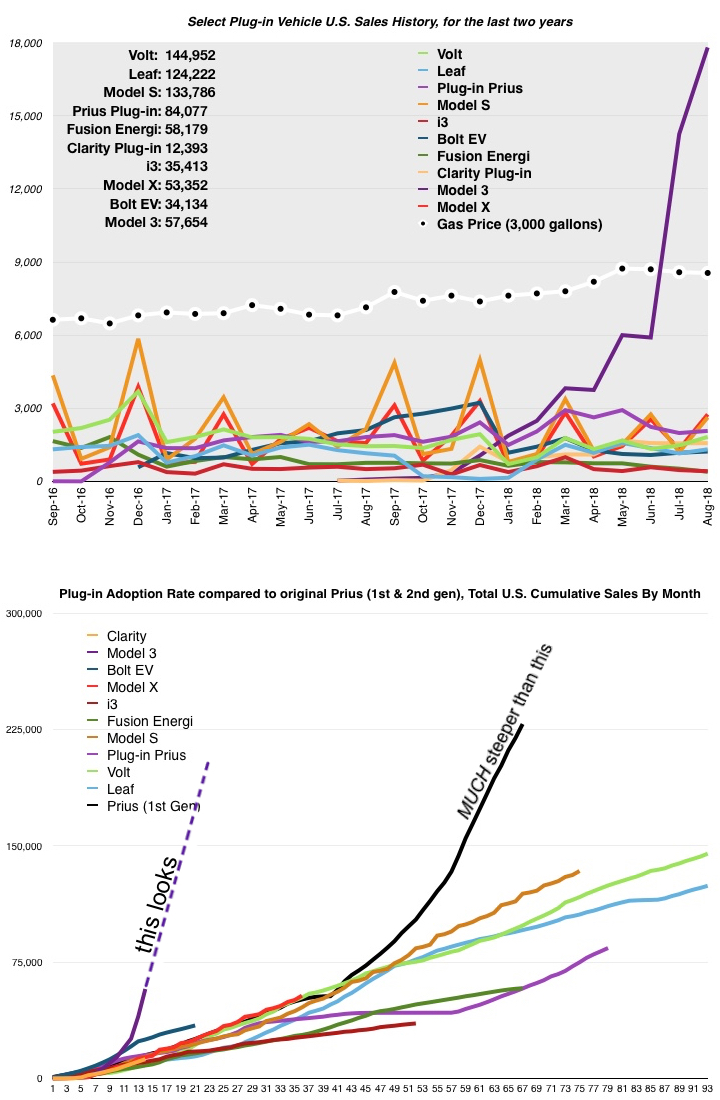

The big news of the month, has to be Tesla Motors’ Model 3 sales. Whereas Model S and Model X sales bounce around with quite a bit of volatility, their sales have stayed fairly close to Volt, Leaf and Prius volume. The Model 3 is a whole different animal. In July, Tesla sold an amazing 14,250 copies of the Model 3. Last month, it jumped again with 17,800 units sold! That’s almost ten times the sales of the Volt! General Motors, which had fallen to second place in total plug-in vehicle sales in the U.S., continues to be on a path to hit the 200,000th plug-in, around late December of this year. Meanwhile, fueled primarily by Model 3 sales, Tesla is already 45,698 past the limit! Well done Elon Musk & crew!

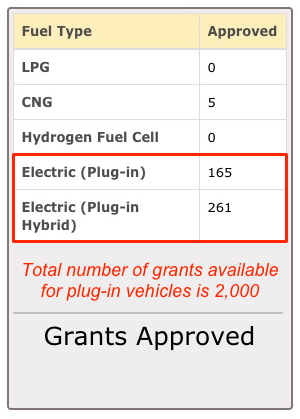

Another item of interest (for residents of Texas, at least) is the number of plug-in vehicle grants that have been handed out. These grants are $2,500 for those who lease or purchase a plug-in vehicle that will remain in Texas. The limit was set at $5M, or 2,000 grants. As shown in the image to the left, 426 of the rebates have been issued. That’s 21% of the available grants. However, I expect the pace to slow a bit, since there was an early rush to grab rebates by those who had acquired their plug-in vehicle on or after the program’s retroactive start of September 1st of last year. I know sales will spike again in December, but at this point, I think the program will run for several more months, probably until the planned end of the program, on September 1st of next year.

Another item of interest (for residents of Texas, at least) is the number of plug-in vehicle grants that have been handed out. These grants are $2,500 for those who lease or purchase a plug-in vehicle that will remain in Texas. The limit was set at $5M, or 2,000 grants. As shown in the image to the left, 426 of the rebates have been issued. That’s 21% of the available grants. However, I expect the pace to slow a bit, since there was an early rush to grab rebates by those who had acquired their plug-in vehicle on or after the program’s retroactive start of September 1st of last year. I know sales will spike again in December, but at this point, I think the program will run for several more months, probably until the planned end of the program, on September 1st of next year.

My dealership’s plug-in vehicle inventory is continuing to rebound from zero Volts and Bolt EVs available. In August, our final 2018 model year Volt orders began arriving. I had ordered 33 units. Right now, we have 19 in stock and 6 inbound orders, which will close out the 2018 Volts. That means my dealership sold at least 8 Volts in August, of which 5 were sold by me. Those 8 Volts represent about 25% of that last order. In August, I placed an order for our very first 2019 model year Volt, for a customer of mine. It will have the new Jet Black/Porcelain Blue leather seats. I’m curious to see what that looks like, in person. 2019 model year Bolt EV orders are well underway. Much of the production is being diverted to South Korea, so they will remain moderately hard to get, in the U.S., with half the ordering opportunities dealers have enjoyed in the past. That being said, we have 11 on order and all but one have customer deposits placed on them already. The only one that is still available is the sole 2LT version I ordered. Very few of my clients go for the lower trim level, but opt for the Premier instead.

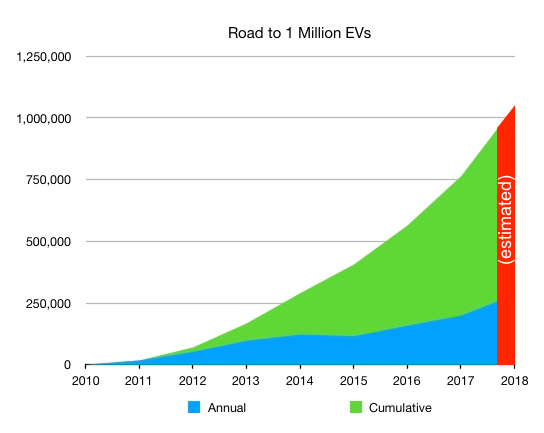

Overall plug-in vehicle sales, fueled by the Model 3, other new models and new manufacturers entering the field, are accelerating to the goal of one million plug-in vehicles in the U.S. Just six weeks ago, my projection graph showed the 1,000,000 mark occurring in late December. With two months’ new data, it now appears the U.S. will achieve that goal in October! (see below) It also appears the U.S. will have its first year that plug-in sales will exceed 280,000 in a single year. Of course, if the Model 3 continues to fulfill orders, at the pace of the last month…who knows how high the numbers can go? In August 2018, the plug-in vehicle sales I track were up, except for the BMW i3 & the Ford Fusion Energi. The Tesla Model 3 increased dramatically, with 17,800 sold in August. (notice the high purple line, in the chart below) I’m still amazed by this! Just take a look at the purple curve in the bottom graph below. This adoption rate dwarfs the previous gold standard, the original Toyota Prius.

In August 2018, the plug-in vehicle sales I track were up, except for the BMW i3 & the Ford Fusion Energi. The Tesla Model 3 increased dramatically, with 17,800 sold in August. (notice the high purple line, in the chart below) I’m still amazed by this! Just take a look at the purple curve in the bottom graph below. This adoption rate dwarfs the previous gold standard, the original Toyota Prius. In the lower chart (above), we can see the Bolt EV adoption curve is now tracking a growth rate similar to that of most of the plug-in vehicles I track. This makes me sad…

In the lower chart (above), we can see the Bolt EV adoption curve is now tracking a growth rate similar to that of most of the plug-in vehicles I track. This makes me sad…

Here are the August 2018 sales figures, compared to the previous month:

- Chevy Volt: UP 24% (1,825 vs. 1,475) **estimated

- Chevy Bolt EV: UP 4% (1,225 vs. 1,175) **estimated

- Nissan Leaf: UP 14% (1,315 vs. 1,149)

- Plug-in Toyota Prius: UP 4% (2,071 vs. 1,984)

- Tesla Model S: UP 119% (2,625 vs. 1,200) **estimated

- Tesla Model X: UP 108% (2,750 vs. 1,325) **estimated

- BMW i3: DOWN 10% (418 vs. 464)

- Ford Fusion Energi: DOWN 24% (396 vs. 522)

- Honda Clarity BEV & PHEV: UP 1% (1,570 vs. 1,560)

- Tesla Model 3: UP 25% (17,800 vs. 14,250)

Reversing the trend we’ve seen lately, in August, the average price of gasoline bounced around, trending downward. It started at $2.88 per gallon and continued down, with short jumps up. The dive bottomed out on August 21st, at $2.82 per gallon. Price rose a little, from there, ending at $2.84 at the end of the month.

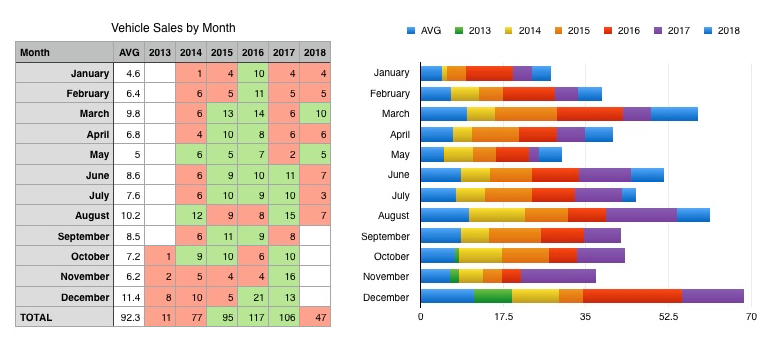

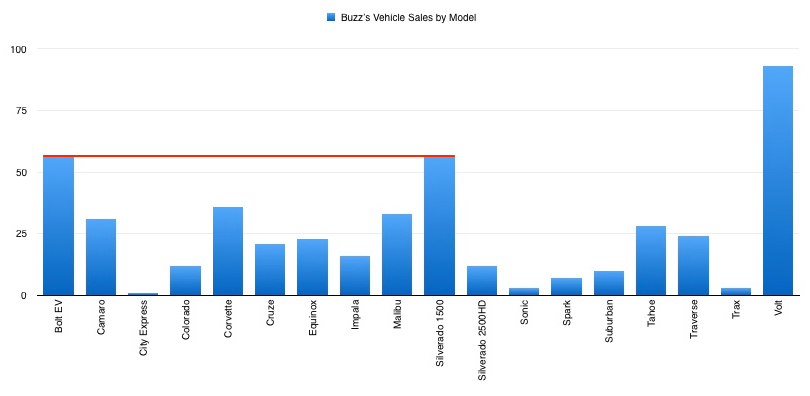

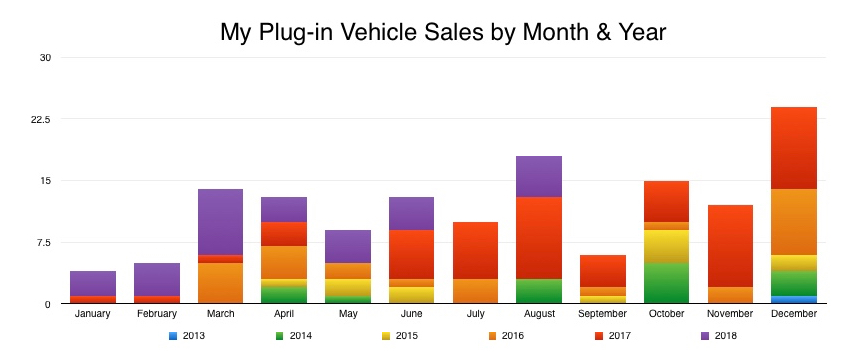

My vehicle sales, in August 2018, rebounded a bit from a dismal July. In August, I sold 7 vehicles, well below my average August total of 10.2 units. Out of 8 months, so far in 2018, six have been below my average for each month. Notice the red and green cells, in the spreadsheet shown below. My seven August 2018 sales were comprised of four Volts, a Bolt EV, a Sonic and a Colorado. The big news here is that, even with a scarcity of Bolt EVs to sell, the Bolt EV has tied my 2nd best-selling vehicle: the Silverado 1500. In 15 months of Bolt EV availability, I have sold as many Bolt EVs as 59 months worth of Silverado sales. 39 out of 57 sales this year have been plug-in vehicles. That’s 68% of my total sales in 2018. My overall volume is down, due to my move to our “EV & Hybrid Sales Center.” In that location, I am seeing far fewer customers, as they usually end up at the main showroom or our Truck Building.

My seven August 2018 sales were comprised of four Volts, a Bolt EV, a Sonic and a Colorado. The big news here is that, even with a scarcity of Bolt EVs to sell, the Bolt EV has tied my 2nd best-selling vehicle: the Silverado 1500. In 15 months of Bolt EV availability, I have sold as many Bolt EVs as 59 months worth of Silverado sales. 39 out of 57 sales this year have been plug-in vehicles. That’s 68% of my total sales in 2018. My overall volume is down, due to my move to our “EV & Hybrid Sales Center.” In that location, I am seeing far fewer customers, as they usually end up at the main showroom or our Truck Building. In the chart below, the purple bars (2018 plug-in sales), when compared to the red bars just below them, showed comparatively strong plug-in sales, through the first three months of 2018. July was my worst month, in total sales, since January 2014, which was only my 4th month in auto sales. With one Bolt EV in stock (a 2LT) and only a few Volts, my plug-in sales were zero, in July.

In the chart below, the purple bars (2018 plug-in sales), when compared to the red bars just below them, showed comparatively strong plug-in sales, through the first three months of 2018. July was my worst month, in total sales, since January 2014, which was only my 4th month in auto sales. With one Bolt EV in stock (a 2LT) and only a few Volts, my plug-in sales were zero, in July. Plug-in sales, compared to the same month a year ago, were mostly up. The losers were the Bolt EV, due to constrained inventory, the BMW i3 and the Ford Fusion Energi:

Plug-in sales, compared to the same month a year ago, were mostly up. The losers were the Bolt EV, due to constrained inventory, the BMW i3 and the Ford Fusion Energi:

- Chevy Volt: UP 26% (1,825 vs. 1,445)

- Chevy Bolt EV: DOWN 42% (1,225 vs. 2,107) **became available nationwide in September 2017

- Nissan Leaf: UP 14% (1,315 vs. 1,154)

- Plug-in Toyota Prius: UP 14% (2,071 vs. 1,820)

- Tesla Model S: UP 22% (2,625 vs. 2,150)

- Tesla Model X: UP 75% (2,750 vs. 1,575)

- BMW i3: DOWN 17% (418 vs. 504)

- Ford Fusion Energi: DOWN 48% (396 vs. 762)

- Honda Clarity BEV & PHEV: UP 10,367% (1,570 vs. 15) **Clarity debuted in July 2017

- Tesla Model 3: UP 23,633% (17,800 vs. 75) **Model 3 debuted in July 2017

One note on the Clarity & Model 3: August 2018 was compared with only the second month of these vehicles’ availability, and they really didn’t sell in volume until December. Due to that, the percentages are more skewed than if they had a “normal” month’s volume to compare to.

On a final note, a comment on Facebook asked me to comment on where I obtain my sales figures. I use several sources, including InsideEVs, GoodCarBadCar, CarSalesBase and hybridCars.

Very informative, the Model 3 sales are outstanding, I wonder how sustainable it is. I read that book model 3 sales exceeded BMW passenger cars https://www.google.com/amp/s/insideevs.com/tesla-model-3-outsold-bmw-passenger-cars/amp/

Meanwhile looking forward to the Bolts coming in next month.