“We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win, and the others, too.” –John F. Kennedy

First, let me make this disclosure: I own a small amount of Lordstown Motors’ stock. If I didn’t, I may have missed this story and the impact it’s having on an industry and on a hard-hit area of the U.S.

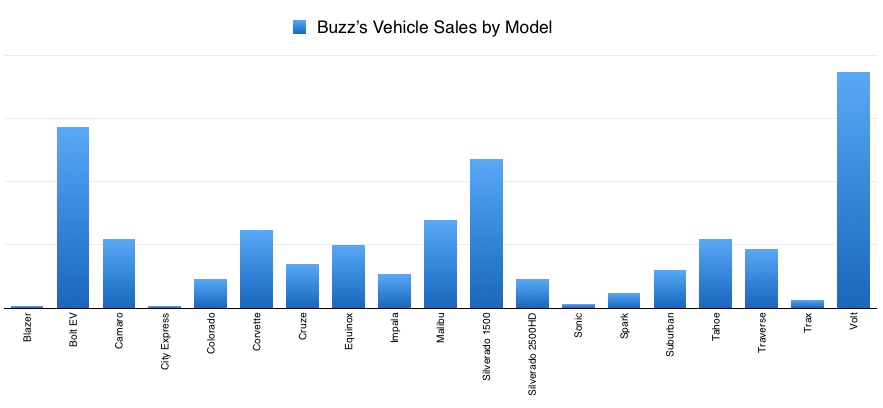

Lordstown Motors is an up-and-coming electric truck manufacturer. Their “Endurance” pickup is a full-sized, crew cab truck, very similar to the Chevrolet Silverado gasoline-powered trucks. I can say this with some authority, as I sold Chevy vehicles for over six years. My specialty was Chevy’s plug-in offerings, the Volt and Bolt EV, but you can’t make a living in the Chevy world (at least not in Texas) without selling lots of pickups and SUVs. During those six years, my sales breakdown was 35% plug-in vehicles, 37% SUVs, crossovers and pickups, 15% sedans and 12% sports cars. So yes, I’ve driven a few Chevy pickups, although I’ve never owned one. I’ve just never been a pickup sort of guy because the cost of operation was just too high and my usage profile doesn’t lend itself to pickups.

I first saw the Endurance pickup, on December 17, 2020, at a showing in Addison, Texas, a suburb of Dallas. I would have produced a video of the event, but the lighting and background noise made for a video of lower quality than I wanted for my YouTube channel and this blog. However, I was very impressed, with the truck. It was said, during this presentation, that this particular Endurance was the only one in existence and that it had to be pried from the hands of the company’s President for the tour through Texas. In the videos I shot, my praise was effusive. I figuratively kicked myself over the number of times I said I was impressed, as I hate repeating myself in my videos. The truck was immediately familiar to me. Its cab interior was very much like the Chevy pickup interiors with which I was accustomed, albeit with a much modernized (i.e. EV-like) dashboard. The truck bed, tailgate and rear bumper was exactly like the Chevys I sold, although there was a 110V outlet in the truck bed for running power tools or, as in the case of the presentation, a big screen TV. Under the hood, was a 20 amp, 110V outlet for charging power tools, while enroute to a jobsite (or cameras and a drone, for a video shoot, in my case).

I’ve been saying for years now that the tipping point for EV adoption will be when full-sized electric pickups and SUVs hit the market. Even Bob Lutz, father of the Chevy Volt, stated that electrifying a small car was a mistake. He felt that the payoff, for the consumer, was too small, since small cars get pretty good gas mileage anyway and that taking a 19 MPG pickup and giving it 75+ MPGe would be a game-changer. Bob was wrong about the Volt but absolutely correct about electrifying larger vehicles. In support of his creation, battery cost was just too high, back when the Volt was developed, to make a 100% electric full-sized pickup and hybrid pickups just didn’t provide enough of an efficiency boost to make them compelling. When Bob was forced out of GM, during the government buyout, he moved to VIA Motors, a company planning to produce a plug-in extended range pickup, similar in operation to the Volt. I first saw their truck in 2017.

My, how times have changed.

The first pickup, in which I felt desire, was the Workhorse pickup, which was never produced. It had some great lines. Then I saw the Tesla Cybertruck announcement. A sizeable percentage of traditional truck buyers are put off by the Cybertruck’s looks, but I absolutely love it. In my eyes, it looked like something with which you’d drive on Mars. I think some of those buyers will be swayed, once the Cybertruck hits the streets (and smokes those other trucks at a stoplight). I thought it would be the first electric pickup to do be produced, but then along came Lordstown Motors.

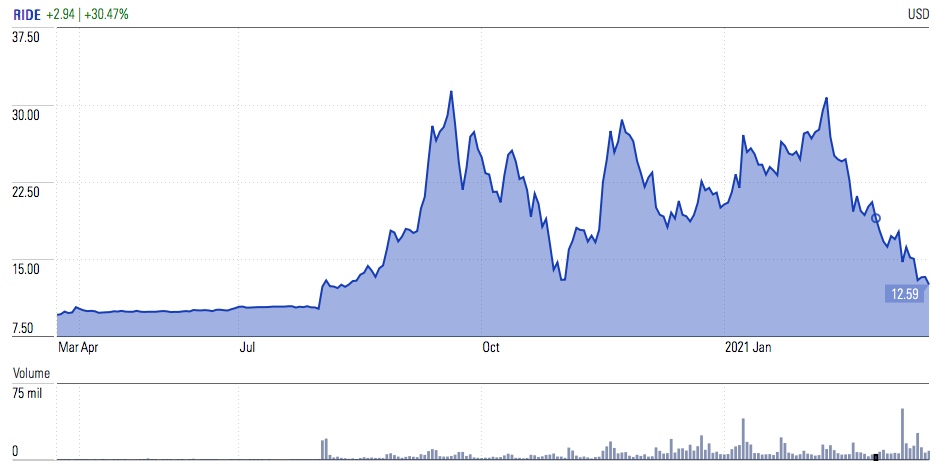

Instead of building an assembly plant from scratch, as Tesla is doing in Austin, Texas for the Cybertruck, Lordstown bought an existing General Motors plant in Lordstown, Ohio (with investment assistance from GM). This gave Lordstown a head start in the race to put an electric pickup on the road. Then, in October 2020, Lordstown completed a reverse merger with a “special purpose acquisition company” or SPAC called DiamondPeak Holdings Corporation. SPACs exist to fund startups to shorten time-to-market by allowing them to go public, through the SPAC, rather than going through an initial public offering (IPO). When announced, the stock spiked, rising from $10.45 per share, on July 31st, to a peak of $31.50, on September 21st, with $675 million, of the funds raised, to fund production of the Endurance. That’s a 201% increase in stock price.

This is reminiscent of the heady days of Internet investment, back in the 1990s, when anyone could start up an internet company and make a killing without making any money first. In this case though, Lordstown had a prototype they were showing around the country and a factory, poised to make a real product. A the time of the merger, the press release stated Lordstown had already “received more than 27,000 pre-orders” for the Endurance, representing $1.4 billion dollars of revenue. For those of you new to the EV world, pre-orders are usually made with deposits of $100 or less and are fully refundable. Tesla’s Model 3 generated over 400,000 pre-orders. It is a method of gauging buyer interest in a new vehicle and getting attention focused on the vehicle manufacturer, in an industry besieged with press releases touting new EVs. In the case of Lordstown though, these pre-orders were said to be from companies operating fleets of vehicles or agents who provide vehicles to fleet operators and not consumers. In fact, Lordstown had stated the fleet market was its target and its greatest opportunity. I’m not sure I agree with that, based on the Tesla Model 3’s sales performance.

On Monday, January 11, 2021, Lordstown Motors issued a press release stating it had received 100,000 pre-orders for the Endurance pickup, stating specifically that these orders were “non-binding.” On the previous Friday, the stock had closed at $21.98 a share. By the close of the market, on the 11th, the stock had risen to $27.11 per share, a 23% increase. Nine days later, on January 20th, the stock closed at $23.27, dropping by 14% from its close on the day of the press release.

A “Business Updates” press release, on January 28th, stated that the company:

- had started metal stamping for the first 57 “beta” vehicles, which were intended to be used a road & crash test vehicles,

- had signed a long-term agreement with LG Energy Solution as the battery provider for the Endurance,

- was continuing to evaluate Camping World as a potential service partner for the Endurance,

- had an electric van in development, which would be unveiled in June with production in the second half of 2022,

- had taken the first step with the General Services Administration to sell vehicles to government fleets,

- and that construction was continuing on a renovation to part of the factory that would produce battery packs.

With no further press releases, on February 11th, the stock reached its highest close, at $30.75, after which the stock began a steady decline in value. A few more press releases were posted, including an announcement that the Endurance’s “skateboard” would be competing in a race in Baja California and a co-marketing, upfitting and services agreement with Holman Enterprises. These press releases didn’t seem to have any major impact on stock price and the stock continued to decline, as the euphoria over the previous announcements started to fade. A friend of mine, who invests in electric vehicle companies told me, around this time, that he had seen drops across several EV-related companies’ stocks and thought that there was some “profit taking by investors” going on.

Then, on March 12, 2021, Hindenburg Research published a report entitled, “The Lordstown Motors Mirage: Fake Orders, Undisclosed Production Hurdles, And A Prototype Inferno.” Hindenburg describes itself as a “forensic financial research” company but is also reported to be actively short-selling Lordstown stock. The report specifically zeroed in on the 100,000 pre-orders as misleading, since the orders were non-binding, which Lordstown had stated in their press release. Several of the groups that placed pre-orders were said to not have the financial ability to make the purchases and appeared to be shell companies set up to become middle-men between Lordstown and fleet buyers. Many disparaging comments, about Lordstown’s Founder and CEO, were said to have been made by “former senior employees” of Lordstown. Several other charges were levied against Lordstown, some of which had already been stated in Lordstown press releases, such as the fact that vehicle testing had not been performed yet, as the beta build necessary to produce the test vehicles was just starting. As is common in anti-EV reporting, the report also mentioned that a prototype had caught fire and was destroyed. One interesting quote, from the report stated, “a former employee explained how the company is experiencing delays and making ‘drastic’ design modifications, putting them an estimated 3-4 years away from production. For example, in mid-January the company ‘totally switched from a plastic exterior to aluminum.” Unless the video below is showing robots welding plastic, (It’s not. I’m being facetious.) this would appear to be proof that Lordstown if further along than the “former employee” stated. I say this, based on the fact that the tooling required to stamp the body panels usually take months of lead time to create and cannot just be retrofitted tools previously used to make plastic body panels. The two manufacturing process are not the same at all.

This video was posted to Lordstown’s YouTube channel on March 17, 2021:

The impact was immediate. Lordstown stock fell from $17.71 on the day before the report was issued to $14.78 the day of the report, a drop of 16% in heavy trading.

The report was published five days before Lordstown was scheduled to hold their fourth quarter and annual financial results call for 2020. Apparently, the company felt it could not wait that long to respond and did so, in a press release on March 15th, in which it stated that it “remains on track for start of production of its Lordstown Endurance all electric pickup truck in September 2021,” calling Hindenburg Research a “short seller.”

Two days later, at the beginning of the earnings call, an executive (I can’t remember which) stated they would not be commenting on the negative reporting as the matter was under investigation by the SEC and an internal committee. The stock has continued to fall and today, closed at $11.38 a share. This represents a drop of 35% since the report was issued by Hindenburg.

Looking at the Hindenburg website, it seems several of their negative reports were aimed at startup electric vehicle manufacturers (Lordstown, Nikola and Kandi), renewable energy and pharmaceutical companies focused on vaccines for COVID-19. In the case of Lordstown Motors, we have a company with which General Motors decided to invest. I assume, they used their expertise in electric vehicles to vet the Lordstown business plan, before investing and selling their factory. That being said, what really gripes me about this is the effect it will have on the people of the area around Lordstown, Ohio. They have been economically devastated by the GM plant closure as well as false promises made by former President Trump that he would reopen the plants in the area. In fact, he told them not to sell their homes and move away, because he was going to save them. The result: the state swung from traditionally Democratic to Republican during the 2016 election and once again, the workers’ hopes were dashed.

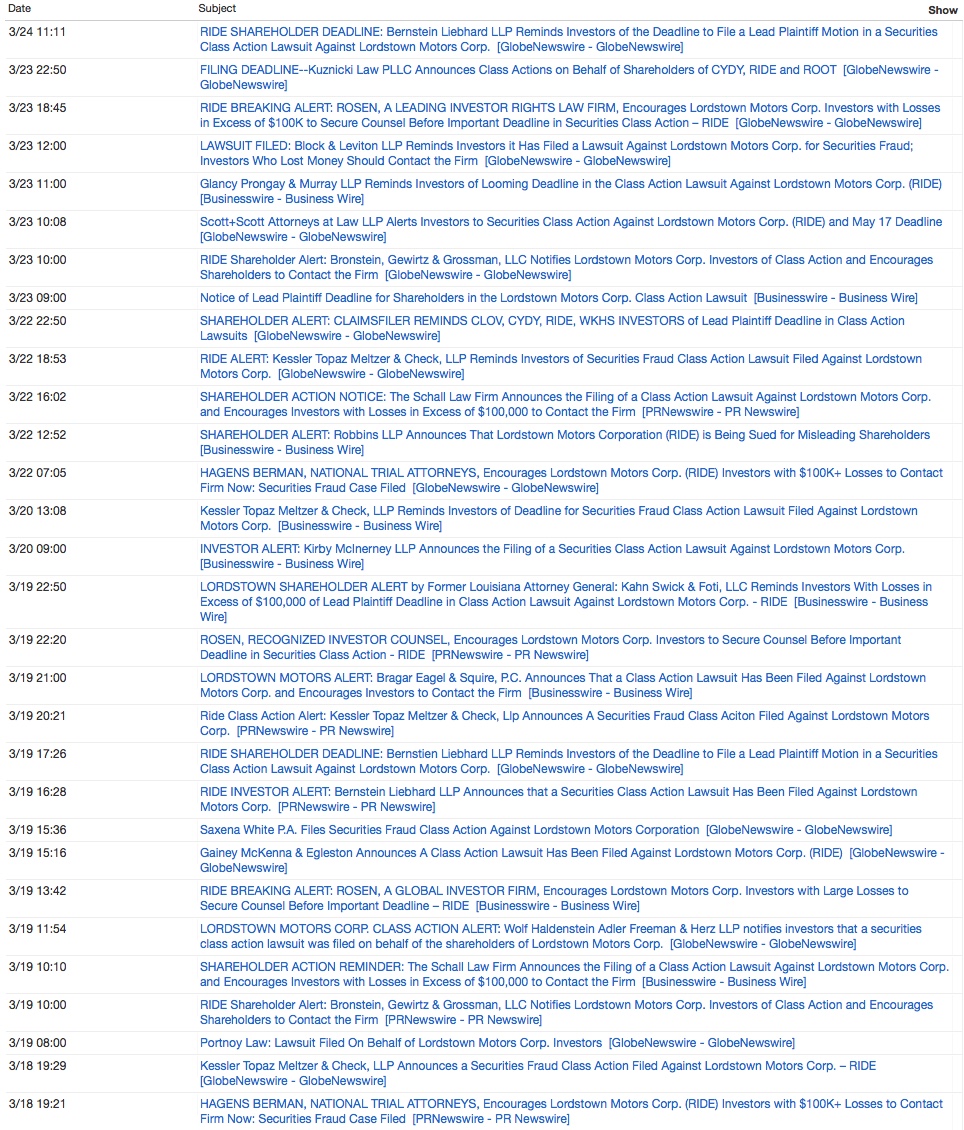

If there has been some malfeasance, on the part of Lordstown’s executives, I hope it is rooted out and remedied, but for the sake of the workers in the area, I hope it’s not true. The workers in Ohio need a break, and producing the first electric pickup truck to hit the roads of the U.S. could be a boon to them. I’m tired of short-sellers betting against U.S. companies, like Tesla Motors, GameStop, Nikola Motors and now, Lordstown. I understand it’s just a way to make a living, but it seems so parasitic and it is so much easier to tear down than to build up. Knowing the litigious nature of our society, I have to hope the funds that were slated to get the Endurance to market doesn’t get spent fighting lawyers, but based on Newswire listings of Lordstown articles, I’m concerned (see below).

If it turns out this was all just overblown B.S., I hope Hindenburg Research crashes and burns, like its namesake, but it’s looking like they’ll turn a fast buck…again.