Beginning on January 1, 2024, EV buyers MAY be able to take the EV tax credit (of up to $7,500 for new EVs, $4,000 on preowned EVs) as a point-of-sale discount. As I whined, back in May 2015, the current version of the tax credit is critically flawed. This change fixes a lot of the problem.

The version of the tax credit, under which EV purchases are still regulated, excludes certain types of potential EV buyers: a) those who could qualify for a loan for an EV if they didn’t have to wait a year to receive the tax credit and b) those whose tax burden was insufficient to qualify for the entire $7,500 credit.

BUYER TYPE “A”

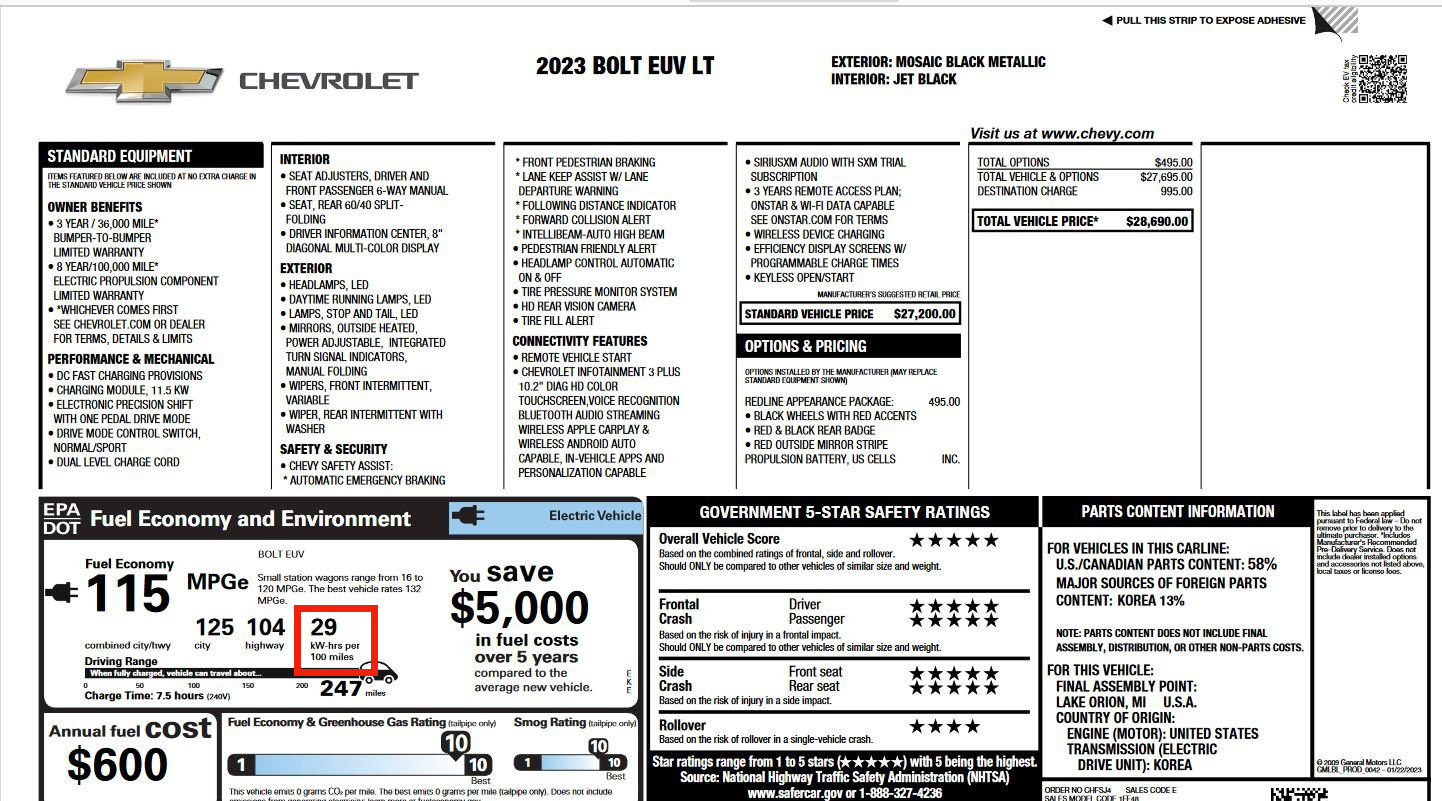

Let’s look at that first type of buyer. If you’re in the market to buy an electric vehicle, the most affordable one currently in production, is the Chevrolet Bolt EV. The MSRP for a bare bones 1LT Bolt EV is $27,495, including destination charge. To make the numbers more widely applicable, let’s assume the buyer has a down payment equal to tax, title & license fees and is only financing the MSRP of the car. (Yes, I am also assuming the dealer does not negotiate the price or the buyer is terrible at negotiating.) A 72 month loan at a 5.9% interest rate would have a monthly payment of $454.37. By transferring the $7,500 tax credit to the dealer and receiving a $7,500 discount, the financed amount would be decreased to only $19,995, resulting in a monthly payment of $330.43. That’s a 27% reduction in payment and incredibly important to lower income buyers!

Let’s dive a little deeper for further advantages:

Just taking the fuel savings into account makes this an even bigger deal. Let’s say this prospective EV buyer drives 12,000 miles a year and is replacing an average sedan, which gets 24.2 miles per gallon. Currently, the average price of gasoline (regular grade) in the U.S. is $3.951. That 12,000 miles of driving would require 495.9 gallons of gas (12,000 ÷ 24.2). The cost of that gasoline would be $1,958.80 per year (495.9 gallons x $3.95). The average monthly cost would therefore be $162.23. ($1,958.60 ÷ 12 months).

Remember that last number…

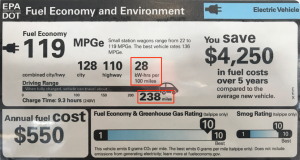

12,000 miles per year is 32.9 miles per day (12,000 ÷ 365), on average. Even a common 110V, 12 amp wall outlet can recharge that much driving in about 8 hours. I am going to assume the EV driver can plug in at home or at work. I fully understand that many drivers can’t, but if they can’t, there are lots of businesses that offer free Level 2 charging in order to attract customers. That 32.9 miles of driving could be recouped in a little over an hour. Yes, that’s not as convenient as charging at home or work, but it’s free. That being said, we’re going to base our calculations on someone who IS paying for the electricity, at their residence. The average price of a kilowatt hour (kWh) of electricity is 17¢ (it’s much cheaper in Texas, where I live). The EV we’re discussing is the Chevy Bolt EV which, according the the EPA section of the window sticker, can travel 100 miles on 29 kWh of electricity (see image below). That means it gets 3.45 miles per kWh (100 miles ÷ 29 kWh).

12,000 miles of driving would require 3,478 kWh of electricity (12,000 miles ÷ 3.45 miles per kWh). The cost of that electricity would be $591.30 per year (3,478 kWh x 17¢ per kWh), resulting in a monthly “fuel” cost of $49.28 ($591.30 ÷ 12 months).

WHY ALL THE MATH???

The monthly “fuel” cost savings, by driving on electricity, would be $112.95 ($162.23 for gasoline – $49.28 for electricity). That doesn’t include the savings on maintenance that EVs provide. Now, let’s apply that monthly savings to the monthly payment for a more realistic monthly cost of owning and operating the Chevy Bolt EV. The effective monthly payment, when compared to an average gasoline-powered car in the U.S., would be $217.48!!! (330.43 monthly payment – $112.95 in monthly fuel savings) My very first new car was a 1976 Chevrolet, with a monthly payment of $170.61, and that was 47 years ago.

That electric vehicle payment is looking pretty delicious right now, isn’t it?

That effective monthly payment can drive mass EV adoption and it’s the best-kept secret in auto sales. Very few dealership salespeople understand the EPA section of an EV’s window sticker. Worse, they don’t want you to know about it, because EV sales take longer, meaning they make less per hour than when selling a traditional internal combustion engine (ICE) vehicle. Why do EV sales take more time? Because EV newbies have tons of questions and are nervous about making the jump to electric driving!

Auto salespeople are not evil or corrupt. I worked side-by-side with many honorable salespeople for six years. But be honest. Would you voluntarily take a huge cut in pay just to help a customer you may never see again?

BUYER TYPE “B”

The tax credit change is also important to those who don’t have enough tax burden to receive the full tax credit amount. The way the tax credit works now, if your entire income tax burden is less than the available credit, you only get back the tax burden, not the larger tax credit everyone else could get. In other words, the tax credit can only reduce your income tax to zero, not generate a refund beyond that. This affects lower income buyers, which includes retirees, like me. Under the rules next year, I could get the entire $7,500 off the price of the vehicle, even if my tax burden is less than $7,500!

This comparison is very important for EV adoption, because mass adoption requires affordability for the masses. If we really believe in equity, electric vehicles cannot be only for the wealthy. If we really want to see manufacturers build more affordable EVs and dealers eager to sell them, they have to see demand for those vehicles. This change to the tax credit will definitely increase demand.

A FEW CAVEATS

A few things to consider:

- I do not know if dealers are required to discount the EV the full amount of the tax credit. As I said earlier, most auto salespeople are honest. Some are not. Make sure you know the rules when you’re shopping and make sure the salesperson knows you know the rules. Demand the full tax credit amount for the specific vehicle in which you’re interested or find another dealer.

- Dealers have to hold state or local licenses in order to offer the credits, and they must register on an Internal Revenue Service website. Many are unaware or just don’t care. Make sure your dealer is in the program. (As a side note: Tesla and Rivian do not have state-licensed dealers.) In fact, dealer associations have sued to make sales of their vehicles illegal in certain states. Their vehicles do qualify for the tax credit but may not qualify for the up-front discount.

- There are income and vehicle MSRP limits as well as restrictions on where the EV was manufactured on the tax credit. Understand the rules and how they apply to your income and vehicle.

- As always, check with your tax advisor to make sure the program works for you and is the best for your needs.

RESOURCES

If you’re a numbers person, as I obviously am, take a look at my MP$Ge calculator and my spreadsheet for comparing total cost of ownership between any ICE vehicle and EV. (I used to have one that included PHEVs, but it’s out of date)

Now, armed with this information, go out there and test drive an EV. You’ll love it!

***UPDATE***

The rules are going to change on battery materials sourcing as early as January 1st. This means that you also need to determine the best time for you to make the transition. Here are some things to consider:

- Are the new battery sourcing rules going to reduce the tax credit for the vehicle you want? The loss could be $3,750, so you have to balance the potential reduction in tax credit with the timing of the new rules and your personal tax burden. https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric-vehicle-tax-credit#2024-ev-tax-credit

- Do you have enough tax burden to get the entire tax credit now? If so, you may want to buy on December 31st (2nd best price negotiating day) and wait for your tax refund unless you are certain the vehicle you want to buy will still get the full tax credit.