Plug-in vehicle sales, compared to the previous month, looked like this:

- Chevy Volt: up 12% (1,490 vs. 1,336)

- Nissan Leaf: up 15% (3,102 vs. 2,687) **again outsold Volt by more than 2-to-1

- Plug-in Toyota Prius: up 9% (451 vs. 479)

- Cadillac ELR: DOWN 24% (118 vs. 155)

- BMW i3: UP 24% (1,013 vs. 816) **a mirror of the loss the previous month

- BMW i8: UP 25% (158 vs. 126) **almost makes up for large loss last month

- Ford Fusion Energi: up 5% (789 vs. 752)

- Ford C-Max Energi: up 2% (659 vs. 644)

- Chevy Corvette Stingray: UP 49%!!!! (3,552 vs. 2,378)

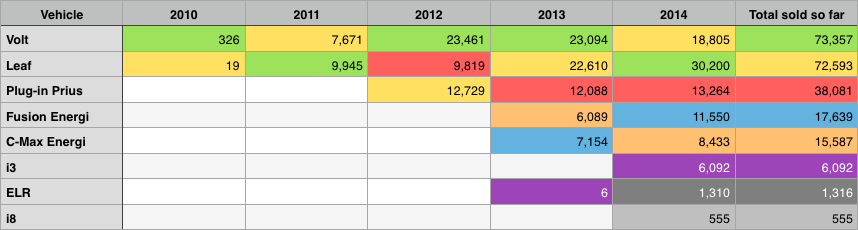

In the table above, each model’s sales are totaled by year. Each color represents the place occupied by each model (green=1st, yellow=2nd, red=3rd, blue=4th, orange=5th, purple=6th, dark grey=7th and light grey=8th). This shows that, in the beginning, it was the Volt that sold more in the first year (really just the month of December 2010). During 2011, the Volt & Leaf were still the only show in town, but conservative media started the anti-Volt drumbeat of “it can only go 40 miles,” “Government Motors” or “they burst into flames.” The Leaf outperformed the Volt in 2011.

In the table above, each model’s sales are totaled by year. Each color represents the place occupied by each model (green=1st, yellow=2nd, red=3rd, blue=4th, orange=5th, purple=6th, dark grey=7th and light grey=8th). This shows that, in the beginning, it was the Volt that sold more in the first year (really just the month of December 2010). During 2011, the Volt & Leaf were still the only show in town, but conservative media started the anti-Volt drumbeat of “it can only go 40 miles,” “Government Motors” or “they burst into flames.” The Leaf outperformed the Volt in 2011.

2012 proved to be the breakout year for the Volt. Sales more than tripled the 2011 total. At the same time, Leaf owners were starting to complain about the Leaf’s battery pack permanently losing capacity in hotter climes. It was this news story that stopped me from getting a Leaf as my first plug-in vehicle and started me on the road to Volt. It also appears to have hurt Leaf sales substantially or at least, delayed its widespread acceptance by a year or so. 2012 also was the year Toyota introduced the Plug-in Prius. The Prius got 2nd place its first year out (in my opinion, due to name recognition and brand reputation rather than the vehicle’s qualities).

2013 saw the addition of even more plug-in vehicles and the Leaf’s return to 2nd place. The Prius became a perennial 3rd place recipient. Analysis beyond that point seems to be limited as the newer vehicles haven’t had time to make a large impact.

December sales started well, ebbed around the holiday, but as New Year’s Eve approached, they jumped up. December 31st and the following Saturday were very busy, with lots of people off work for the holiday. Here in Texas, lots of people went shopping even though it was cold and rainy.

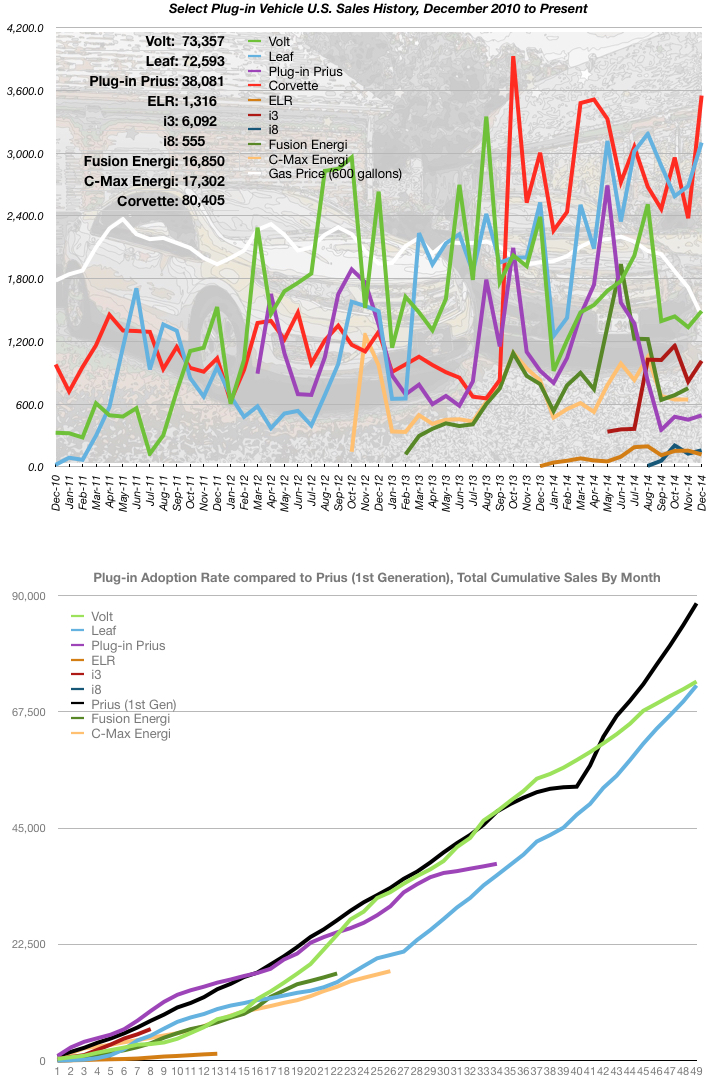

In today’s news, the price of oil is collapsing, falling below $50 per barrel for a short time this morning. Just take a look at the gasoline price curve (in white, top graph)!!!

Almost all the plug-ins I track enjoyed increased sales in December, leading me to believe the income tax credit trumped the loss in fuels savings (due to price of gasoline being so low). Several people I worked with in December were on a mission to get an EV for that very reason.

I mentioned two months ago that the Leaf’s total US sales, could surpass the Volt’s by March or April of next year. I now believe it will happen well before then. In total sales since inception, The Volt has outsold the Leaf by only 764 units. Again in December, the Leaf’s sales were more than twice the Volt’s. In fact, the monthly advantage enjoyed by the Leaf in seven of the last twelve months was large enough to put the Leaf in 1st place in all-time sales, if it occurs again in January.

I mentioned two months ago that the Leaf’s total US sales, could surpass the Volt’s by March or April of next year. I now believe it will happen well before then. In total sales since inception, The Volt has outsold the Leaf by only 764 units. Again in December, the Leaf’s sales were more than twice the Volt’s. In fact, the monthly advantage enjoyed by the Leaf in seven of the last twelve months was large enough to put the Leaf in 1st place in all-time sales, if it occurs again in January.

Also, in the bottom graph, the plight of the plug-in Prius becomes evident. Its drop in monthly sales volume really got going about six months ago. In my opinion, as the hybrid EV buying public becomes more informed, we’ll see some of the vehicles with limited electric range fall by the wayside. In my opinion, GM got this right on the Volt. 40 miles of all electric range is crucial for the success of a plug-in hybrid. Those with less electric range will have a much smaller market to live within, as the first generation of EV owners starts considering their next EV and will have learned much from their first EV.

Finally, the BMW i3 is starting to become more apparent in the bottom graph (red curve). Its acceptance curve is staying right between the Volt (light green) and the original Prius (black).

The ELR is the only plug-in I track (and whose sales volume has been announced…I’m looking at you Ford…) with decreased sales in December, when compared to the previous month. The ELR is in a tough spot. It’s price point, and the fact that the new Volt will be shown to the public next week, is a problem for the Cadillac. If the ELR keeps the current Voltec drive train, while the new Volt gets an update, the ELR will suffer even more. I really want GM to find a way to make this car succeed.

Sales, compared to the same month a year ago, looked like this:

- Chevy Volt: DOWN 38% (1,490 vs. 2,392) **new iPhone syndrome??

- Nissan Leaf: UP 23% (3,102 vs. 2,529)

- Plug-in Toyota Prius: DOWN 46% (492 vs. 919) **perhaps the buying public is getting smarter about plug-ins…

- Cadillac ELR: UP 1967% (118 vs. 6) ** don’t get too excited. This jump is compared to the very first month of ELR availability.

- BMW i3: (did not exist a year ago)

- BMW i8: (did not exist a year ago)

- Ford Fusion Energi: (??? vs. 752) **awaiting Ford’s numbers

- Ford C-Max Energi: (??? vs. 644) **awaiting Ford’s numbers

- Chevy Corvette Stingray: down 6% (3,552 vs. 3,005)

The most notable item in the lower graph, is the adoption rate of the ELR. It is well below all other plug-ins I currently track (and very much like the Mitsubishi iMiEV, which I stopped tracking, due to very low sales). Even the Fords are cruising at the adoption rate of the Leaf, at the time the Leaf was struggling with bad publicity, surrounding battery degradation, in the Arizona Summer. Although I thought the ELR a beautiful car, I am unable to justify purchasing one when there are several better performing EVs well below the price of the ELR.

One concern I have is the acceleration of the original Toyota Prius (black curve, bottom graph). It is pulling away from the top plug-in performers (Volt & Leaf). Are people waiting to see what the 2016 Volt is going to be? Is that wait hurting sales of both Volts & Leafs? The jump in sales for the original Prius seems to align with availability of the 2nd generation Prius in August 2003. Perhaps we’ll see a similar jump when the new Volts hit the streets.

Seems like the ELR has the same problem the Cimarron had, people aren’t paying the premium for it because they can clearly see that it’s a re-badged Chevy.

I hate to tell you, but ALL Caddys are rebadged Chevys. The reason the ELR isn’t selling is because it was priced $20K too high out of the gate, plain and simple.