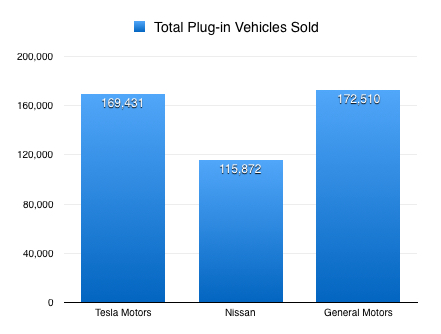

This month, I’m going to start the countdown to 200,000 vehicles, for the three manufacturers that can possibly hit that mark this year: General Motors, Tesla Motors and Nissan. Once that happens, these manufacturers are scheduled to have the $7,500 Federal Income Tax Credit begin to phase out. The mechanics of how this happens can be found here. Here’s how it looked as of the end of last month:

Tesla averaged 4,179 vehicle sales per month last year and the Model 3 production is ramping up. If they maintain last year’s rate, Tesla could be at the 200,000 mark by August. General Motors averaged 3,658 plug-in vehicle sales per month last year, but the Bolt EV was not available in all 50 states until August. At that rate, the 200,000 mark would happen in August, as well. That would mean the 200,000 could get cut in half by December 31st of this year. Nissan averaged 936 plug-in vehicle sales per month last year. At that rate, they would hit the 200,000 mark years from now. However, that’s misleading. Their sales, last year, were hampered by the announcement of a new, redesigned Leaf with much better range (although well short of the Model 3 or Bolt EV). Sales lagged for months as consumers waited for the new Leaf. I expect all these manufacturers’ average sales to be much better, but unless they’re phenomenal, Nissan buyer’s will still be getting the full tax credit into 2019.

February 2018 plug-in vehicle sales were up, across the board, which is very abnormal for February.

As I mentioned a couple months ago, I have dropped the Ford C-Max Energi from the tracking, as Ford has decided to end the model. It has been replaced, in my tracking, by the Honda Clarity EV and Hybrid models. I am combining the two plug-in versions of Clarity, but not the hydrogen fuel cell version.

In total vehicle sales, February 2018 was typical. I sold 5 units. The weather was cold and rainy for the last week of the month and traffic was very low.

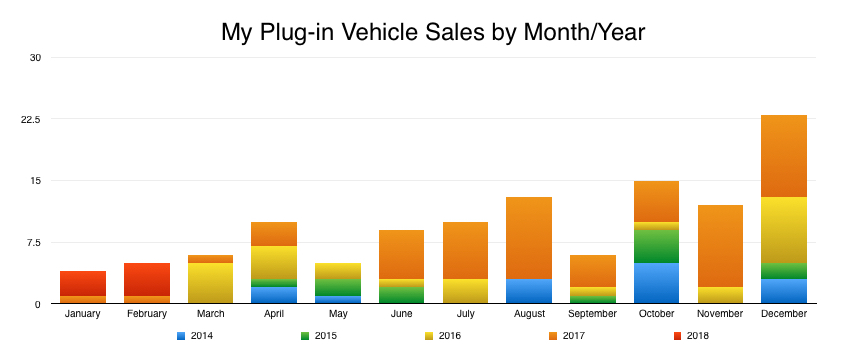

In the chart below, the February rebound in plug-in sales is obvious. All the curves jump up, in the last month. Here are the February 2018 sales figures, compared to the previous month:

Here are the February 2018 sales figures, compared to the previous month:

- Chevy Volt: UP 38% (983 vs. 713)

- Chevy Bolt EV: UP 21% (1,424 vs. 1,177)

- Nissan Leaf: UP 497% (895 vs. 150) **new model

- Plug-in Toyota Prius: UP 37% (2,050 vs. 1,496)

- Tesla Model S: UP 41% (1,125 vs. 800) **estimated

- Tesla Model X: UP 25% (875 vs. 700) **estimated

- BMW i3: UP 63% (623 vs. 382) **new model announced

- Ford Fusion Energi: UP 24% (794 vs. 640)

- Honda Clarity BEV & PHEV: UP 55% (1,234 vs. 797)

- Tesla Model 3: UP 33% (2,485 vs. 1,875)

In February, the average price of gasoline dropped from $2.59 per gallon, at the start of the month, to $2.55 at month’s end. The dive was pretty constant, hitting $2.51 on the 18th, bouncing up for a few days, before bottoming out on the 26th at $2.50, before recovering some of its loss.

I am shocked by the continued robust sales of the Volt and Bolt EV. As you are probably aware, due to the Federal Income Tax Credit on plug-ins, most sales are biased toward the last half of the year, as people start thinking about their income taxes. Until 2017, I had never sold a plug-in vehicle in January or February. In 2017, I only sold one Volt, during each of those months. However, the world is born anew in 2018! In January 2018, I sold two Bolt EVs and a Volt. In February, I sold three Bolt EVs and a Volt. Is this an indicator that we’re moving beyond first adopters of new technology and more into mainstream buyers? My five February 2018 sales were comprised of three Bolt EVs, one Volt, and one Equinox, which means the Bolt EV is rapidly rising, in my overall lifetime sales by model. It is still in 3rd place (42 units), with the Silverado 1500 (55 units) in 2nd place and the Volt (76 units) in first. The Bolt EV got there in eight months. I’ve been selling the other vehicles for 53 months!

My five February 2018 sales were comprised of three Bolt EVs, one Volt, and one Equinox, which means the Bolt EV is rapidly rising, in my overall lifetime sales by model. It is still in 3rd place (42 units), with the Silverado 1500 (55 units) in 2nd place and the Volt (76 units) in first. The Bolt EV got there in eight months. I’ve been selling the other vehicles for 53 months! By vehicle type, my lifetime sales are 28% plug-ins, 20% SUVs, 18% pickups (down 1%), 15% sports cars. The rest are sedans & vans (19%).

By vehicle type, my lifetime sales are 28% plug-ins, 20% SUVs, 18% pickups (down 1%), 15% sports cars. The rest are sedans & vans (19%).

Plug-in sales, compared to the same month a year ago, were split:

- Chevy Volt: DOWN 46% (983 vs. 1,820) **Bolt EV effect?

- Chevy Bolt EV: UP 50% (1,424 vs. 952)

- Nissan Leaf: DOWN 14% (895 vs. 1,037) **new model

- Plug-in Toyota Prius: UP 51% (2,050 vs. 1,362)

- Tesla Model S: DOWN 46% (1,125 vs. 1,750)

- Tesla Model X: UP 9% (875 vs. 800)

- BMW i3: UP 96% (623 vs. 318)

- Ford Fusion Energi: DOWN 5% (794 vs. 837)

- Honda Clarity BEV & PHEV: (was not available in February 2017)

- Tesla Model 3: (was not available in February 2017)

I sure hope GM has planned ahead for price cuts when the federal credits phase out. Nissan has stayed publicly that they have planned for this event.

I’m sure GM has a plan in place, although that’s way above my pay grade. Every EV manufacturer has known about the approaching end of the FITC and most have planned accordingly. I wonder if some of the companies that entered the market much later, did so to have an advantage over the earlier manufacturers.

I sure hope you are right but I am nervous! I want more and better Volt-like vehicles in the future. I want to be able to drive many more miles than even a Bolt can do. From my house it’s 400 miles to Quebec City and no guaranteed way to fully charge. I need the ICE.

I want more and better Volt-like vehicles in the future. I want to be able to drive many more miles than even a Bolt can do. From my house it’s 400 miles to Quebec City and no guaranteed way to fully charge. I need the ICE.

Just make sure your desires aren’t driving you to purchase a 1% vehicle…

Thanks for the data-driven post, Buzz. If the US administration doesn’t extend the EV tax credits they are hitting US manufacturers