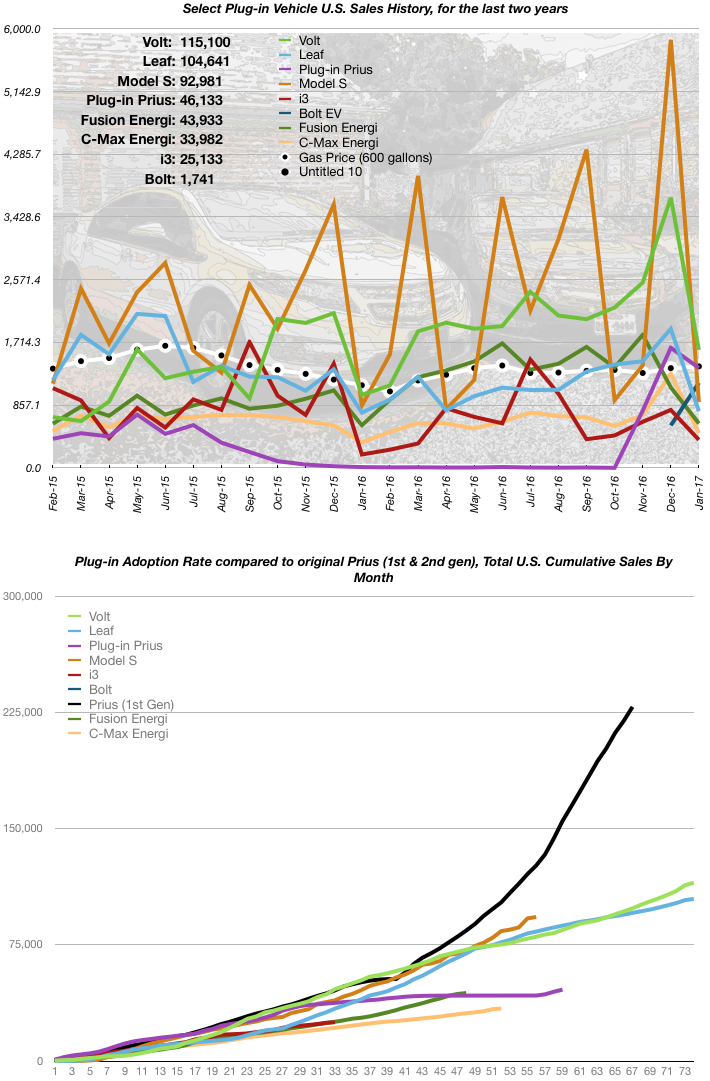

In January 2017, plug-in vehicle sales were down sharply, except for one model I track, The Chevy Bolt EV. The January drop is normal, in the electric vehicle space, due to the Federal Income Tax Credit for plug-in vehicles. Buyers of these vehicles make purchases in December, in order to get the tax credit relatively quickly, when they file their taxes early in the following year. In fact, almost every single vehicle I track has shown a drop in sales in EVERY January, when compared to the previous month. The only exception goes back to January 2011, when the Nissan Leaf showed an increase in sales volume the month after it was first released. The Bolt EV has pent up demand, due to its 238 mile EV range, at a price starting at $37,495 ($29,995 after tax credit) and for the awards it has garnered. The Bolt EV is the first EV to have an electric range over 200 miles at a price below $70K. Currently (pun intended), the Bolt EV is only available to residents of California and Oregon, but unlike the Chevy Spark EV, which also has limited geographic availability, General Motors plans on making the Bolt EV available nationwide, later this year.

Here are the January 2017 sales figures, compared to the previous month:

- Chevy Volt: DOWN 56% (1,611 vs. 3,691)

- Chevy Bolt EV: UP 101% (1,162 vs. 579) *Bolt EV was not available for the entire previous month

- Nissan Leaf: DOWN 59% (772 vs. 1,899)

- Plug-in Toyota Prius: DOWN 17% (1,366 vs. 1,641)

- Tesla Model S: DOWN 85% (900 vs. 5,850) **estimated

- BMW i3: DOWN 52% (382 vs. 791)

- Ford Fusion Energi: DOWN 45% (606 vs. 1,099)

- Ford C-Max Energy: DOWN 63% (473 vs. 1,289)

In December, the average price of gasoline dropped steadily in the U.S., until the 29th, when is started to stabilize. Gas averaged $2.31 per gallon, over the month. January sales were quite a contrast to the busy December sales rush. Traffic was terribly low at my dealership. I only had four sales for the month, two of which were counted by General Motors as December sales, as they occurred on January 3rd, which marked the end of the GM month (GM never ends a month on a weekend). All four of my sales were made in the first 13 days of January. Since I had no sales after January 13th, I’m considering believing in triskaidekaphobia!

January sales were quite a contrast to the busy December sales rush. Traffic was terribly low at my dealership. I only had four sales for the month, two of which were counted by General Motors as December sales, as they occurred on January 3rd, which marked the end of the GM month (GM never ends a month on a weekend). All four of my sales were made in the first 13 days of January. Since I had no sales after January 13th, I’m considering believing in triskaidekaphobia!

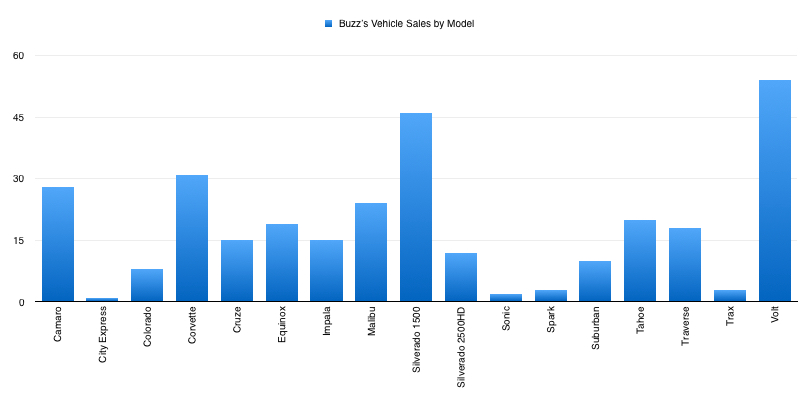

My sales, by vehicle, included one Volt, two Silverado 1500s and a Suburban. This shaved the Volt lead, over my second best selling vehicle by one unit, and as of now, Volt leads Silverado 1500 by eight units, over my career in vehicle sales.

Plug-in sales, compared to the same month a year ago, were mostly up, with the BMW i3 being the only vehicle I track that shows a decline in sales, year-over-year. The YUGE increase, in Plug-in Prius sales were due to the lack of interest in the previous generation and the introduction of the new version, in November of last year, dubbed “Prius Prime.” Looking at the top sales graph above, the purple sales curve at the very bottom, shows how poorly the previous generation Prius plug-in sold. Loyal Prius customers learned of the increased range of the Prius Prime and decided to wait or move to a different brand/model. Due to this, the percentage change in sales over the previous January looks enormous, when in fact it was the second-best, in monthly sales, last month. The Chevy Volt took top honors with a total of 1,611 units, compared to the Prius Prime’s volume of 1,366 units. Due to the poor Prius sales over most of 2015 and 2016, the increase percentage may continue to look incredibly high, until at least November 2017 (unless the Prius Prime’s sales drop precipitously, in the coming months).

- Chevy Volt: UP 62% (1,611 vs. 996)

- Chevy Bolt EV: (was not available in January 2016)

- Nissan Leaf: UP 2% (772 vs. 755)

- Plug-in Toyota Prius: UP 13,560% (1,366 vs. 10) **previous generation Prius plug-in, dying out last January

- Tesla Model S: UP 6% (900 vs. 850)

- BMW i3: DOWN 55% (382 vs. 850)

- Ford Fusion Energi: UP 4% (606 vs. 581)

- Ford C-Max Energi: UP 35% (473 vs. 350)