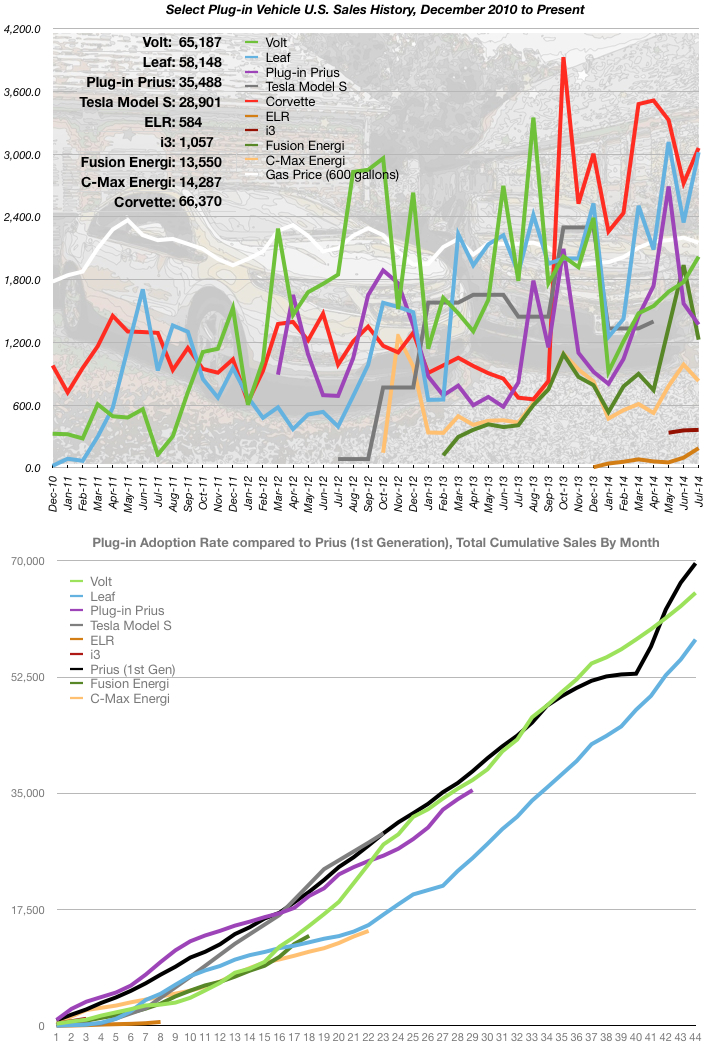

Lots of changes to the tracking this month. Two new plug-ins have been added, due to their sales performance, the Ford Fusion Energi and the Ford C-Max Energi. The Fusion Energi in fact, bested the Chevrolet Volt and Plug-in Prius! The C-Max Energi hasn’t fared quite as well, but its numbers were enough, in my opinion, to start tracking them as well. These two have been off my radar because I could not understand why someone would select one of them over the Volt or Leaf, since their batteries are so much smaller. But the purpose of these monthly sales performance posts is to document said sales performance, not try to predict it. With Ford becoming a significant plug-in vendor, they should be watched!

As usual, not all the numbers have been announced. BMW, Ford and Toyota will announce their sales figures tomorrow. Tesla will be problematic as they do not separate sales by month or country.

The news so far is that every vehicle we track (except one), for which sales figures have been announced, showed increased sales over the previous month. This includes our benchmark vehicle, the Chevrolet Corvette. The one exception? The Prius plug-in dropped by 200 units from last month’s figures. **UPDATED** Oops. It wasn’t that good a month for everyone. The two new vehicles, both Fords, dropped sales volume wham compared to the previous month.

Sales, compared to the previous month, looked like this:

- Chevy Volt: up 14% (2,020 vs. 1,777)

- Nissan Leaf: up 29% (3,019 vs. 2,347)

- Plug-in Toyota Prius: DOWN 13% (1,371 vs. 1,571)

- Tesla Model S: (awaiting figures)

- Cadillac ELR: up 94% (188 vs. 97)

- BMW i3: (awaiting figures)

- Ford Fusion Energi: down 37% (1,226 vs. 1,939)

- Ford C-Max Energi: down 16% (831 vs. 988)

- Chevy Corvette Stingray: up 12% (3,060 vs. 2,723)

One thing, that’s been going on for a few months now, is the Toyota Prius Plug-in has been out-selling the Volt year-to-date. Beginning with May 2014, when the Prius Plug-in outsold the Volt by over 1,000 units, the Prius has lead the Volt (year-to-date). The last two months, the Volt has outsold the Prius Plug-in, but it just hasn’t outsold the Prius enough to catch back up with the YTD figure. The YTD advantage, enjoyed by the Prius Plug-in currently (pun intended), is just 36 units. The Volt has handily beaten the Prius Plug-in over the last two months, so next month should be interesting…

**UPDATED** Sales, compared to the same month a year ago, were up for every vehicle except for the Chevy Volt. It looked like this:

- Chevy Volt: DOWN 25% (2,020 vs. 2,698)

- Nissan Leaf: up 36% (3,019 vs. 2,225)

- Plug-in Toyota Prius: up 68% (1,371 vs. 817)

- Tesla Model S: (awaiting figures)

- Cadillac ELR: (did not exist a year ago)

- BMW i3: (did not exist a year ago)

- Ford Fusion Energi: up 301% (1,226 vs. 407)

- Ford C-Max Energi: up 192% (831 vs. 433)

- Chevy Corvette Stingray: way up 359% (3,060 vs. 853)

One interesting thing, on the charts, that jumped out at me, was the adoption rates of the Volt (light green curve) and Fusion Energi (dark green curve). These two vehicles’ adoption rates, over the first 17 months of availability, are very similar.

Gas prices, after 8 months of steadily rising prices, decreased in price, over the last month. I’m not sure, but I think gas prices are not, regardless of complaints, a main driver of EV sales. When gas gets close to $4 per gallon, that’s when I notice a real upswing in questions about the Volt from clients.

Leaf sales are surprising to me in one way: The stories of permanent battery capacity loss do not seem to have had an effect on sales. Just in the last month, Nissan announced a replacement battery pack that is less affected by heat. The price for the new pack is $5,499 after the previous battery pack is traded in. Normally, I would think an announcement like that would give people pause. Certainly, questions had to arise about battery longevity, reliability, range anxiety, etc. Admittedly, Nissan has some very aggressive leases available on the Leaf and one friend, whose employer pays him for mileage driven, showed me how his Leaf is effectively a free car. Buying market share is definitely part of the Nissan strategy. Even at the rate sales are proceeding with the Volt & Leaf, the Leaf will probable not displace the Volt in total U.S. sales during this year. Even at an advantage of 1,000 vehicles per month, it would still take the Leaf until February 2015 to surpass the total number of Volts sold in the U.S., since its debut. However, in 2014 the Leaf is kicking the Volt’s butt in sales by 48% year-to-date! (15,755 Leafs vs. 10,635 Volts)

As usual, I will update this post as more figures become available. On to August!