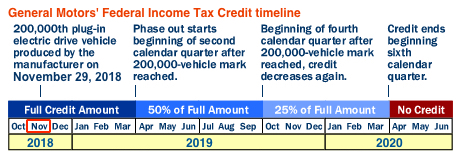

September 2019 is the last month for GM plug-in vehicles to qualify for the $3,750 Income Tax Credit. On October 1st, the tax credit will be reduced to $1,875 and six months after that, on April 1st 2020, to zero.

In the DFW area of Texas, GM is offering $9K off of GM’s Supplier Pricing for everyone. That means that even our most loaded Bolt EV would be priced at under $30K, once you factor in your income tax credit. If you’re currently leasing a GM vehicle, you can save substantially more.