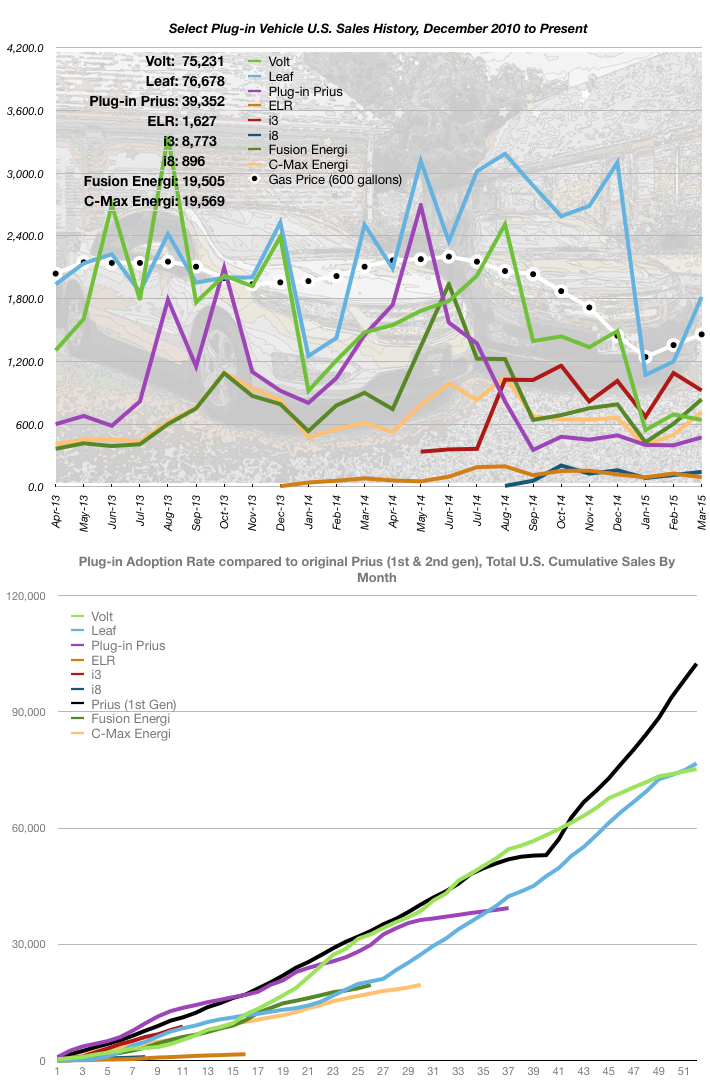

The Nissan Leaf outsold the Chevy Volt by almost 1,200 vehicles. I continue to attribute this to very good leasing deals on the Leaf and the impending release of the redesigned Volt.

In March 2015, plug-in vehicle sales were mixed for the plug-in vehicles I track, compared to the previous month. Down were the Chevy Volt, BMW i3 and Cadillac ELR.

Overall, February’s sales looked like this:

- Chevy Volt: Down 8% (639 vs. 693 – the last 3 months have been the worst Volt sales since they were first introduced)

- Nissan Leaf: UP 52% (1,817 vs. 1,198)

- Plug-in Toyota Prius: UP 19% (397 vs. 401)

- Cadillac ELR: DOWN 28% (127 vs. 92)

- BMW i3: DOWN 15% (1,089 vs. 670) Super Bowl ad paying off???

- BMW i8: UP 27% (113 vs. 85)

- Ford Fusion Energi: UP 39% (603 vs. 426)

- Ford C-Max Energi: UP 44% (498 vs. 395)

The price of gasoline continued to rise for another month, from an average of $2.07 in January to $2.43 in March (a 17% increase).

Sales, compared to the same month a year ago, looked like this:

- Chevy Volt: DOWN 43% (693 vs. 1,210)

- Nissan Leaf: DOWN 16% (1,198 vs. 1,425)

- Plug-in Toyota Prius: DOWN 62% (397 vs. 1,041)

- Cadillac ELR: UP 119% (127 vs. 58) **Don’t get too excited: very small numbers.

- BMW i3: (did not exist a year ago)

- BMW i8: (did not exist a year ago)

- Ford Fusion Energi: DOWN 23% (603 vs. 779)

- Ford C-Max Energi: DOWN 10% (397 vs. 1,041)

In the lower graph,you can see three main adoption paths. They are:

- BMW i8 and Cadillac ELR: The i8 may have sufficient sales volume as it is a very exclusively priced EV. The ELR never has caught on very well.

- Ford C-Max Energi, Fusion Energi, BMW i3, Plug-in Prius” (all exhibiting similar slopes in recent months) All of these, even with the recent month-over-month increases, see to be lagging substantially.

- Original Prius, Chevy Volt, Nissan Leaf: The best adoption rates so far.

Shocker: the Fiat 500e sold 1310 units in March according to Inside EVs, but it’s only sold in CA.