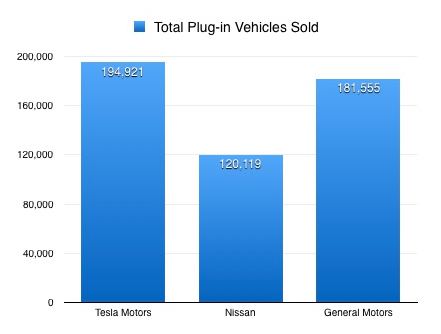

There are developments in the countdown to 200,000 plug-in vehicles, and the looming end of the $7,500 Federal Income Tax Credit. I mentioned last month, that Tesla should hit the limit in July 2018. It now appears possible that, barring any sort of rule change issued by the government, Tesla could lose the tax credit as early as the end of September 2018. This could happen, IF Tesla reached the 200,000th sale this month. So far, in the first five months of this year, Tesla has delivered 33,250 vehicles (Model S, X and 3). That’s a monthly average of 6,650 units. Tesla, at the end of May, was only 5,079 vehicles away from the 200K limit. In other words, if Tesla just turns out the number of vehicles in June, that it has averaged each month this year (when Model 3 production was having difficulties), those sales will trigger the beginning of the end of the Federal Income Tax credit for Tesla vehicles. The only way I think this can be avoided, would be for Tesla to divert some of their new vehicle sales, to buyers outside the U.S., until after the end of June. If they did this, they could hang onto the tax credit for another three months, extending it to the end of 2018. Meanwhile, over at General Motors, I have noticed a profound lack of plug-in inventory. We are down to only two Volts and two Bolt EVs. To contrast, back in early November, my dealership alone had over twenty of each model in stock! Within a 250 mile radius of my dealership, there are only eight 2017 Bolt EVs and ZERO 2017 Volts. Within that same area, there are only twenty-nine 2018 Bolt EVs and thirty-eight 2018 Volts. I have not been able to order new Bolt EVs, since January 26th. The way this normally works, for the uninitiated, is that General Motors allocates production, for a specific vehicle, to dealers who have success selling that vehicle. In other words, sell a lot of Bolt EVs, and you can get a lot more Bolt EVs. Volts have also been very difficult to order. The logjam just broke, and we have 18 Volts on order. However, before this rush (at the end of 2018 model year production) I have to go all the way back to October 2nd of LAST YEAR, with the exception of custom orders for clients, to see our last order. In the region in which Classic Chevrolet is located, we are a top seller of Volt and Bolt EV. I still do not understand where all my allocation went! It is possible that GM has been playing chess and reducing domestic production, to stretch the availability of the tax credit to the end of 2018. If Tesla hits the limit this month, GM’s strategy (if that’s what this is) would result in a pricing advantage against the Tesla Model 3 vs. The Bolt EV/Volt for one quarter. Possibly more important, since the Model 3s currently in production are not anywhere near the $35K base price, it would mean having a pricing parity against GM’s newest competitors in the plug-in world (i.e. Honda Clarity, 2nd gen Nissan Leaf and Toyota Prius Prime). If General Motors only delivers the average monthly number of plug-in vehicles they’ve sold this year, they will hit the 200K mark in LATE DECEMBER. Pushing that back just a few days, would delay it until January 2019. That would mean the tax credit could possibly last until June 2019, for GM. I don’t really think that’s possible, due to the year-end rush to buy vehicles, especially those that give a tax break.

Meanwhile, over at General Motors, I have noticed a profound lack of plug-in inventory. We are down to only two Volts and two Bolt EVs. To contrast, back in early November, my dealership alone had over twenty of each model in stock! Within a 250 mile radius of my dealership, there are only eight 2017 Bolt EVs and ZERO 2017 Volts. Within that same area, there are only twenty-nine 2018 Bolt EVs and thirty-eight 2018 Volts. I have not been able to order new Bolt EVs, since January 26th. The way this normally works, for the uninitiated, is that General Motors allocates production, for a specific vehicle, to dealers who have success selling that vehicle. In other words, sell a lot of Bolt EVs, and you can get a lot more Bolt EVs. Volts have also been very difficult to order. The logjam just broke, and we have 18 Volts on order. However, before this rush (at the end of 2018 model year production) I have to go all the way back to October 2nd of LAST YEAR, with the exception of custom orders for clients, to see our last order. In the region in which Classic Chevrolet is located, we are a top seller of Volt and Bolt EV. I still do not understand where all my allocation went! It is possible that GM has been playing chess and reducing domestic production, to stretch the availability of the tax credit to the end of 2018. If Tesla hits the limit this month, GM’s strategy (if that’s what this is) would result in a pricing advantage against the Tesla Model 3 vs. The Bolt EV/Volt for one quarter. Possibly more important, since the Model 3s currently in production are not anywhere near the $35K base price, it would mean having a pricing parity against GM’s newest competitors in the plug-in world (i.e. Honda Clarity, 2nd gen Nissan Leaf and Toyota Prius Prime). If General Motors only delivers the average monthly number of plug-in vehicles they’ve sold this year, they will hit the 200K mark in LATE DECEMBER. Pushing that back just a few days, would delay it until January 2019. That would mean the tax credit could possibly last until June 2019, for GM. I don’t really think that’s possible, due to the year-end rush to buy vehicles, especially those that give a tax break.

Production of the 2018 Bolt EV will cease on the 27th of July, with 2019 Bolt EV production starting three days later. Production of the 2018 Volt will cease on the 17th of August, with 2019 Volt production starting three days later.

Short rant: GM, PLEASE start advertising the Bolt EV and Volt! Have you seen the Honda Clarity TV ads? Last month Honda sold one more Clarity than GM sold Volts! Their customers KNOW how it works and know it exists as a viable choice for their families. At the same time, I meet potential buyers, every single day, who are shocked to learn GM has a car like the Volt. I hear others say, “Does GM still make the Volt? I thought they’d killed it off!” In less than a year, Honda has outsold GM’s flagship hybrid.

You think TV ads might have helped???

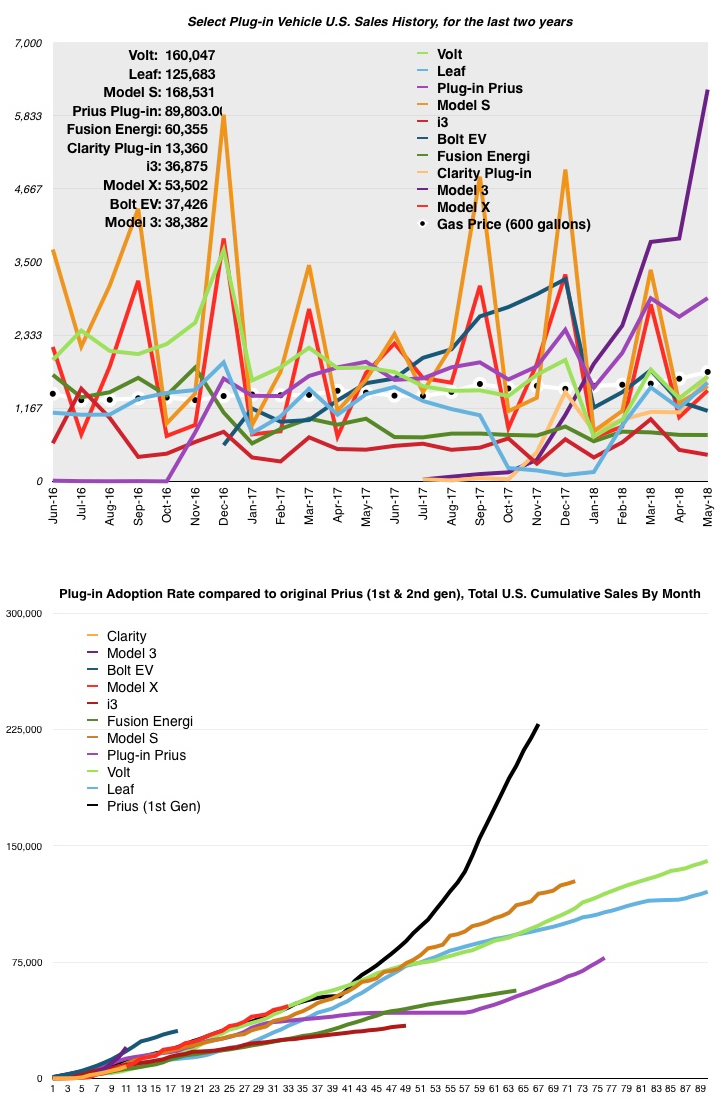

May 2018 plug-in vehicle sales were mixed, with most vehicles I track showing increased sales, over the previous month. The big jump last month was the Model 3, which even topped Model S’s high water mark, for monthly sales (see far right purple spike in chart below). In the lower chart (above), we see the Bolt EV adoption curve, after an historical start, now tracking parallel to the the three leading plug-ins (Bolt EV, Volt and Leaf). The huge increase in Model 3 sales, now have it caught up with Bolt EV production at 11 months of availability. The plug-in Prius adoption rate has accelerated, with the advent of the Prius Prime. The big news, of course, is the Tesla Model 3. It posted a new monthly sales record for Tesla. Prior to last month, the best plug-in vehicle sales record for a single month was held by the Model S, at 5,850 units sold. However, in May 2018, the Model 3 recorded 6,250 (estimated) sales in the U.S.

In the lower chart (above), we see the Bolt EV adoption curve, after an historical start, now tracking parallel to the the three leading plug-ins (Bolt EV, Volt and Leaf). The huge increase in Model 3 sales, now have it caught up with Bolt EV production at 11 months of availability. The plug-in Prius adoption rate has accelerated, with the advent of the Prius Prime. The big news, of course, is the Tesla Model 3. It posted a new monthly sales record for Tesla. Prior to last month, the best plug-in vehicle sales record for a single month was held by the Model S, at 5,850 units sold. However, in May 2018, the Model 3 recorded 6,250 (estimated) sales in the U.S.

Here are the May 2018 sales figures, compared to the previous month:

- Chevy Volt: UP 26% (1,675 vs. 1,325) **estimated

- Chevy Bolt EV: DOWN 12% (1,125 vs. 1,275) **estimated

- Nissan Leaf: UP 35% (1,576 vs. 1,171)

- Plug-in Toyota Prius: UP 11% (2,924 vs. 2,626)

- Tesla Model S: UP 22% (1,520 vs. 1,250) **estimated

- Tesla Model X: UP 41% (1,450 vs. 1,025) **estimated

- BMW i3: DOWN 16% (424 vs. 503)

- Ford Fusion Energi: UNCHANGED (740 vs. 742)

- Honda Clarity BEV & PHEV: UP 52% (1,676 vs. 1,101)

- Tesla Model 3: UP 61% (6,250 vs. 3,875)

In May, the average price of gasoline rose from $2.81 per gallon, at the start of the month, to $2.98 on the 24th, followed by a very gradual drop through the end of the month to $2.95 per gallon. That’s a 5% increase, compared to the previous month’s 6% increase. Personally, I’m hoping for $5 per gallon gasoline…

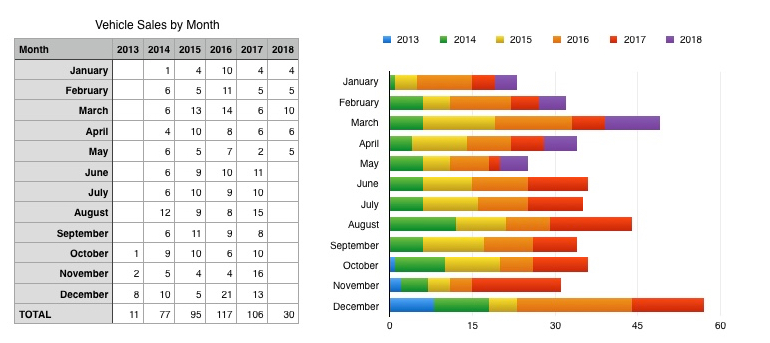

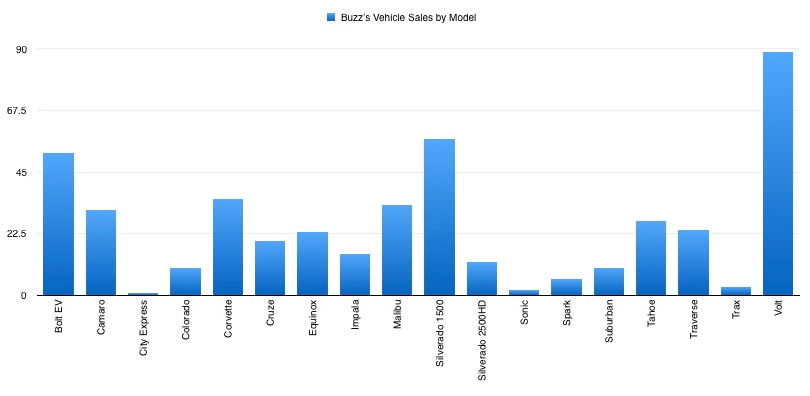

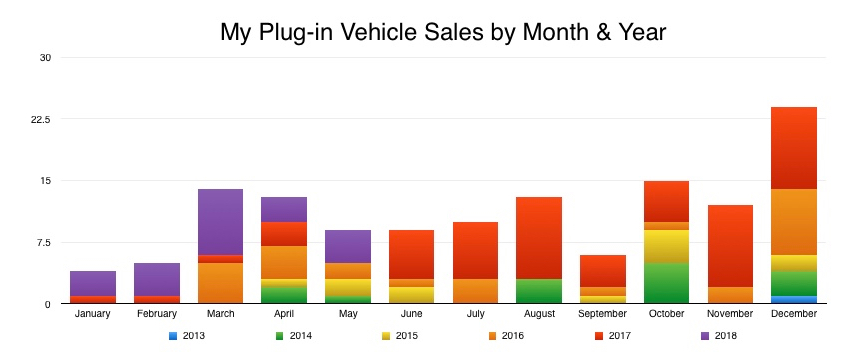

In my vehicle sales, May 2018 was about average for May. I sold 5 units, which is exactly my average May sales for the previous 4 years. My five May 2018 sales were comprised of one Bolt EV, three Volts and a Tahoe. The rebound of interest in the Volt continues and my Volt sales and Bolt EV sales (in 2018) are exactly the same (15 units of each). My Bolt EV sales are, over the last 11 months, closing in on my Silverado 1500 sales, over my 4 year and 8 month auto sales career, trailing by only 5 units. I think it highly probable that my Bolt EV sales will surpass my Silverado 1500 sales within one of the next two months! By vehicle type, my lifetime sales are: 31% plug-ins, 19% SUVs, 18% pickups, 15% sports cars. The rest are sedans & vans (17%). The amazing thing though, is that my plug-in sales, for 2018 alone, are at 75% of my total vehicle sales! It was 55% of my sales in 2017 and 23% in 2016. I think the Electric Avenue concept has worked out.

My five May 2018 sales were comprised of one Bolt EV, three Volts and a Tahoe. The rebound of interest in the Volt continues and my Volt sales and Bolt EV sales (in 2018) are exactly the same (15 units of each). My Bolt EV sales are, over the last 11 months, closing in on my Silverado 1500 sales, over my 4 year and 8 month auto sales career, trailing by only 5 units. I think it highly probable that my Bolt EV sales will surpass my Silverado 1500 sales within one of the next two months! By vehicle type, my lifetime sales are: 31% plug-ins, 19% SUVs, 18% pickups, 15% sports cars. The rest are sedans & vans (17%). The amazing thing though, is that my plug-in sales, for 2018 alone, are at 75% of my total vehicle sales! It was 55% of my sales in 2017 and 23% in 2016. I think the Electric Avenue concept has worked out.

In the chart below, the purple bars (2018 plug-in sales), when compared to the slivers of red below the purple bars (2017 sales), the change is astounding, over the first three months of 2018. In April, sales patterns seemed to go back to normal, but in May 2017, I didn’t sell a single plug-in vehicle (notice no red bar). May 2018 was a completely different story, with four sales!

In the chart below, the purple bars (2018 plug-in sales), when compared to the slivers of red below the purple bars (2017 sales), the change is astounding, over the first three months of 2018. In April, sales patterns seemed to go back to normal, but in May 2017, I didn’t sell a single plug-in vehicle (notice no red bar). May 2018 was a completely different story, with four sales! Plug-in sales, compared to the same month a year ago, were mostly down. Only the Nissan Leaf and the Prius Prime fared better:

Plug-in sales, compared to the same month a year ago, were mostly down. Only the Nissan Leaf and the Prius Prime fared better:

- Chevy Volt: DOWN 8% (1,675 vs. 1,817)

- Chevy Bolt EV: DOWN 28% (1,125 vs. 1,566) **not available nationwide in May 2017

- Nissan Leaf: UP 13% (1,576 vs. 1,392)

- Plug-in Toyota Prius: UP 53% (2,924 vs. 1,908)

- Tesla Model S: DOWN 6% (1,520 vs. 1,620)

- Tesla Model X: DOWN 16% (1,450 vs. 1,730)

- BMW i3: DOWN 16% (424 vs. 506)

- Ford Fusion Energi: DOWN 26% (740 vs. 1,000)

- Honda Clarity BEV & PHEV: (was not available in May 2017)

- Tesla Model 3: (was not available in May 2017)

China has something like 27 electric car companies according to a video I saw on YouTube, and a representative of the Chinese industry said that China plans to be the world leader in electric vehicles. Meanwhile Trump is seeking to subsidize coal plants, and our auto makers evidently plan to keep pushing ICE vehicles. They won’t even advertise their EV products if they have one.

One more sign the American empire and American innovation are collapsing.

Interesting post on Greencarreports:

“Then the Chevy Bolt came along a few years later, but neither has been setting the world on fire when it comes to sales”

The Bolt/Ampera did set the world on fire. Sales don’t happen simply because GM doesn’t produce enough of them.

I have never heard of a company that refuses to produce a product to meet the demand for it. Is GM so insistent on continuing to foul America’s air that it refuses to produce enough EVs for the people who want to buy them.

Just in from Cleantechnica re GM’s commitment to EVs:

“In the US, General Motors has two EVs for sale — the Chevy Volt and the Chevy Bolt. But in China, it has just doubled down on its electric car plans. According to Reuters, Matt Tsien, head of operations for GM in China, told the press in Shanghai this week the company plans to launch 10 more heavily electrified vehicle models in China between 2021 and 2023. It has already committed to offering 10 electrified models by 2020. ‘Clearly, we have a strategy in place and there is an implementation in place to do that,’ Tsien said.

” . . . The stark contrast between GM’s embrace of electric cars in China compared to its mulish refusal to do the same in America is shocking . . . . In the US, it is leading the charge to roll back fuel economy standards so it can continue selling highly profitable light duty pickup trucks and SUVs. ‘Two face’ is about the kindest thing one can say about GM’s bifurcated priorities. It appears the profits it derives from selling cars to Americans are being used to subsidize its push into the Chinese market.

“The result is China will get the crème de la crème of low emissions vehicles while one of America’s largest employers will continue to deliberately poison its customer base in pursuit of profits. That’s the thanks America gets for bailing out The General during the last global economic meltdown. Here’s a note to Mary Barra and the rest of the GM board: ‘Thanks for nothing, GM.’ Signed: American taxpayers.”

Unfortunately, current business practices in the U.S. are focused on quarterly results rather than long-range strategy. Any CEO that ignores easy profits, while pursuing some other strategy that may not pay off for years, will quickly be out of a job. It’s sad, but it’s the reality of where we are. The Chinese government has taken away all doubt about where they want their auto industry (and it’s customers’ yuan) to go. GM, in my opinion, is trying to walk the middle line, grabbing easy profits now, but staying in the EV game (23 new plug-ins planned for U.S. by 2023, co-development of battery packs with Honda). Time (and the buying patterns of the American consumer) will tell…

“23 new plug-ins planned for U.S. by 2023”

That’s a surprise. I wonder how many of them will be “imported” from GM’s Chinese plants?

https://www.freep.com/story/money/cars/general-motors/2018/06/12/gm-plans-expanded-bolt-production-20-new-electric-vehicles-2023/685108002/

This is a good example of how Wall Street (or more broadly American capitalism) does not only not serve the best interests of the American people but in fact works against their best interests.

It’s GAME OVER for gasoline and the internal combustion engine according to the following videos.

Graphene batteries: they charge 5 times faster than current batteries (allowing a 430 mile charge in 20 minutes), increase the energy capacity by 45 percent, and will be cheap to produce. Samsung has already developed one:

https://www.youtube.com/watch?v=Go2g_BNpG_Y&list=LLx0quQVCuvZiP-nSZoemF7w&t=0s&index=2

By 2025 all new vehicles produced will be all electric. No one will want a gasoline powered car by then. EVs will be cheaper to buy by 2022 than the equivalent gasoline car and 10-100 times less to maintain:

https://www.youtube.com/watch?v=E7Jg1IJ68_g&list=LLx0quQVCuvZiP-nSZoemF7w&index=4

Have you heard any rumors about when Samsung or other manufacturer will release the first generation of graphene batteries for use in EVs or consumer electronics (cell phones, laptops, etc.)?

I haven’t heard anyone say when graphene batteries will become available.

More criticism of GM on Cleantechnica today about it “slow walking” into EVs in the U.S.:

“Interestingly, General Motors is a participant [in a plan to encourage utilities to install EV charging stations around the country]. Think about that for a moment. A legacy US auto manufacturer that is slow walking its way into the electric car future, that allows its dealers to put salespeople on the floor who try to talk people out of buying electric cars, that is rushing to build electric cars in China while letting its EV efforts in North America languish — that General Motors — is supporting a program that asks utilities and taxpayers to do the heavy lifting on EV charging infrastructure while it takes a hands-off position on the matter.”

https://cleantechnica.com/2018/06/19/utilities-urged-to-embrace-electric-vehicle-charging-infrastructure-by-transportation-electrification-accord/

I understand your impatience, but I have to ask, “Did the automakers build the gas stations that are so common today?” I also understand GM’s side of things. Their problems are: 1) low profitability of EVs, 2) very high profitability in ICE vehicles, 3) high development costs for EVs, research to find new battery/charging technologies, 4) development of self-driving vehicle hardware & software and 5) the perception that ownership of vehicles will be replaced by something like Uber/Lyft.

Corporations are ruled by shareholders, who want stock prices to go up NOW. THIS quarter. If leadership in a company focuses on long-range goals or just improving the environment, instead of profits, new leadership will be brought in, via a stockholder revolt or a sell-off of the company’s stock. It’s unfortunate, but investing in the stock market has become gambling and a get-rich-quick mindset. VERY few investors look at the long game. Due to this, older industries have a rougher time keeping their stock price rising, when compared to the latest hot ticket item, like the Internet bubble of the 90s.

As for uneducated salespeople, GM does not employ the dealerships. GM can and does offer training (albeit not very in-depth) on EVs and can penalize those individual dealership employees who do not complete said training, by not paying out manufacturer bonuses. However, there are multiple ways a salesperson might not have access to those bonuses. For instance, if individual sales goals are not met, if customer satisfaction surveys fall below the required goal, if other programs/products are being incentivized by the manufacturer and the goals for the program are not met. Everyone at my dealership complete all the required training, but many are still unable to discuss EVs in depth. My opinion is that if the salesperson doesn’t drive an EV regularly, the cannot sell effectively, because most client questions require an understanding of living every day with an EV. Volt owners always ask about public charging and are shocked to hear me say they’ll almost never use it. I have been driving a Volt for almost six years and I have plugged into public chargers about three times, mostly out of curiosity. I do not want to hang out at a Walgreens for four hours, just to get another 53 miles of EV range, when I have an on-board gas engine. I charge at home, and when possible, at work, while I’m busy doing something else (like sleeping…at home only!). In larger cities, the benefit of public charging would be primarily enjoyed by those who cannot charge at home (like apartment dwellers). The advent of newer EVs with MUCH longer range (i.e. Bolt EV, 2nd generation Leaf, etc) the need for chargers, in major cities, will be mostly for those who cannot charge at home. The days of 90 miles of range being considered sufficient are ending. However, these cars also open up the possibility of cross-country travel. THAT’S what should be driving the selection of charger location. Elon Musk’s idea of “destination chargers” between major cities is the right approach to fulfill that need. This is especially important for the western states, which have huge distances between cities.

Electric utilities are (probably) the best to develop this. In Europe, Shell Oil has stated they’ll put chargers in at existing gas stations, but I REALLY don’t want to sit at a gas station for multiple hours at a time.

There is a real risk that this “slow walking” will give a competitive advantage to Chinese manufacturers of EVs. Due to government control, they don’t have to depend on a gambling investor class to “bless” their decision to focus on pollution-free transportation. https://www.theev-angelist.com/4728-2/, https://www.theev-angelist.com/giving-americas-future-to-china/, https://www.theev-angelist.com/the-writings-on-the-wall/

I don’t know how the gas stations came about (would you build one in the hope that people would buy gasoline autos?), but I do know that a HUGE advantage to owning a Tesla is access to its extensive fast charging network.

In the big GM bailout, the U.S. government should have insisted on voting stock and used it to steer the company into the EV age, the stock price be damned. Wall Street and our form of capitalism are standing in the way of progress.

China already has 26 EV companies thanks to government intervention. They are leaving us in the dust (or the smog).

Actually, in the GM bailout, The government tried to kill the Volt program. Bob Lutz fought hard to keep it, saying the future of the company depended on it. As for China, the Chinese automotive market is the largest in the world, at 35% of all new vehicles being sold there. All vehicle manufacturers will be focused on that market. Due to their severe pollution problems, the Chinese government is very supporting of EVs. With a looming trade war (which had been a campaign talking point, by the current administration, during the campaign) the Chinese government, which controls their economy directly, is preparing to take over the EV market. Competition is good, IF we’re willing to compete. Unfortunately, many of our politicians are in the pocket of the fossil fuel industry, which will fight like a cornered animal, to try to remain viable, as their business declines.

Our government tried to kill EVs while the Chinese government is going all in for EVs.

The U.S. government is a right-wing government run by corporations and the super wealthy, in other words an oligarchy, regardless of what party is in charge. I guess that’s the difference.

To be fair, the General Motors bailout was approved in December 2008, after the election of President Obama. The attempt to kill off the Volt project was in 2009, once Obama was in office and when the Chinese weren’t doing anything important in the EV world. I do agree that the U.S. has become an oligarchy and both political parties are complicit in this.