As I mentioned last month, I’ve been expecting my plug-in sales to plummet, due to a double-whammy: the halving of the federal income tax credit for GM plug-ins and the end of the Texas rebate for plug-in vehicles. In April, I had two Bolt EV sales, one of which was an order placed in March, by an electric utility. The utility purchase was based on budgeting and was not affected by the tax credit issue.

Then, May hit…

I did not sell a single plug-in vehicle, in May 2019. The last time that happened, was July 2018. Back then, the problem was not demand, it was supply. I had one Volt in stock and NO Bolt EVs.

Last month, supply was not a problem. I had seven Volts (a single 2018 and six 2019’s). On top of that, I had thirty-five Bolt EVs. Very few people came to the dealership, asking about either. The one 2018 Volt was sold by another salesperson, who has a Bolt EV in his household. That Volt was incentivized at 18% off MSRP by GM. Even then, it took a while to sell. Several potential customers asked about future support for the Volt, since GM had killed it off, in February. There is some trepidation about the Volt. This has been reflected in total U.S. sales of the Volt, which plummeted in April and May to their lowest levels, since August 2011. This may partially be due to lack of inventory, as production ceased on February 15th, but from my perspective, that’s not the whole story. I have plenty of Volts, for one month’s typical sales.

Another issue that may be affecting plug-in sales, at Classic Chevrolet, is that we closed the EV & Hybrid Sales Center and turned the building into executive offices and the “International Building.” That building now houses a sales staff that is fluent in Spanish. I have moved two buildings away, to Classic’s Truck Building. This is apropos, since GM considers the Bolt EV to be a truck, in the inventory control system. However, the chargers aren’t as easy to move as I am. The inventory still sits at that end of the dealership. If a potential customer arrives to check out the plug-in vehicles, the most likely salesperson to appear does not understand the vehicle. As we’ve seen before, plug-in vehicle buyers have done a lot of research, before visiting the dealership. They have deeper questions than a truck buyer would have. If unable to get the answers they need, they will move on to another dealership and possibly another brand.

As an example of this, one of the salespeople, located in that building, told me he had just met a person interested in the Bolt EV. He asked questions about their driving habits and was told the potential buyer drove about 500 miles per week. The salesperson said something to the effect of, “Then the Volt is what you should be considering, since it has a gasoline backup.” When he told me this, I was dumbfounded. I told him, “That’s not correct at all. If the customer drives 500 miles per week, he is probably averaging 100 miles per day, at the most. Driving a Volt would force them to use gasoline for half their driving, unless they could charge at work. The Bolt EV’s 238 mile range would easily cover their need, even if they could not charge at work, or if they worked out of their home. The Bolt EV could then be fully recharged overnight by using a Level 2 charger.” His response was that he gave them a Volt brochure after the test drive and that they left to check out the Kia Niro EV, which is another plug-in vehicle they were considering.

The Kia Niro EV is similar to the Bolt EV in range and MSRP.

Compounding the problem of my lack of proximity to our Volt/Bolt EV inventory is a steep drop in dealership traffic. I’ve had many days, over the last two months, where I did not meet a single potential buyer of any sort of vehicle. Although there have been Toyota, Ford, Lexus and GMC dealers very close to our location for years, new dealerships have been springing up, like BMW, Infiniti and Audi, increasing competition. The drop in traffic also causes increased competition and friction between salespeople at my dealership. We are all paid on commission, so if we do not sell a vehicle, we don’t earn commissions.

There is no base salary.

As salespeople become more concerned with low traffic, they invariably try to catch every “up” they can and attempt to sell a vehicle, even if it is one they know little about. (An “up” is a car sales term for someone that shows up at the dealership and a “phone up” is someone that calls into the dealership.) I was concerned that this sales slump was affecting my dealership but not other Chevy dealers, that were located in less competitive areas, so I took a look at sales reports for Chevrolet dealers in our region. We still are a top-performing dealership, when compared to others, so all dealerships (or at least all dealerships for which I can find sales data) in our region must be suffering a sales slump as well.

This month, the dealership’s Sales Manager has come to my aid, by moving many of our Bolt EVs to an area facing the highly trafficked frontage road in front of my new building. Hopefully, I can meet some people interested or curious about the Bolt EV.

To what do you attribute the steep drop in sales? Are you concerned about your job? The economy? Potential trade wars or actual wars? I’d really like to know how you feel about job security and the economy these days. What the heck is going on??? Leave a comment with your view of things!

If you or a friend are considering a new vehicle, please come see me! I’m starting to wonder if my time in car sales is drawing to an end, as GM announced that Cadillac will become their flagship EV brand. Below, are the May 2019 sales figures, compared to the previous month. Their sales were all up, albeit some barely so, except for the Honda Clarity.

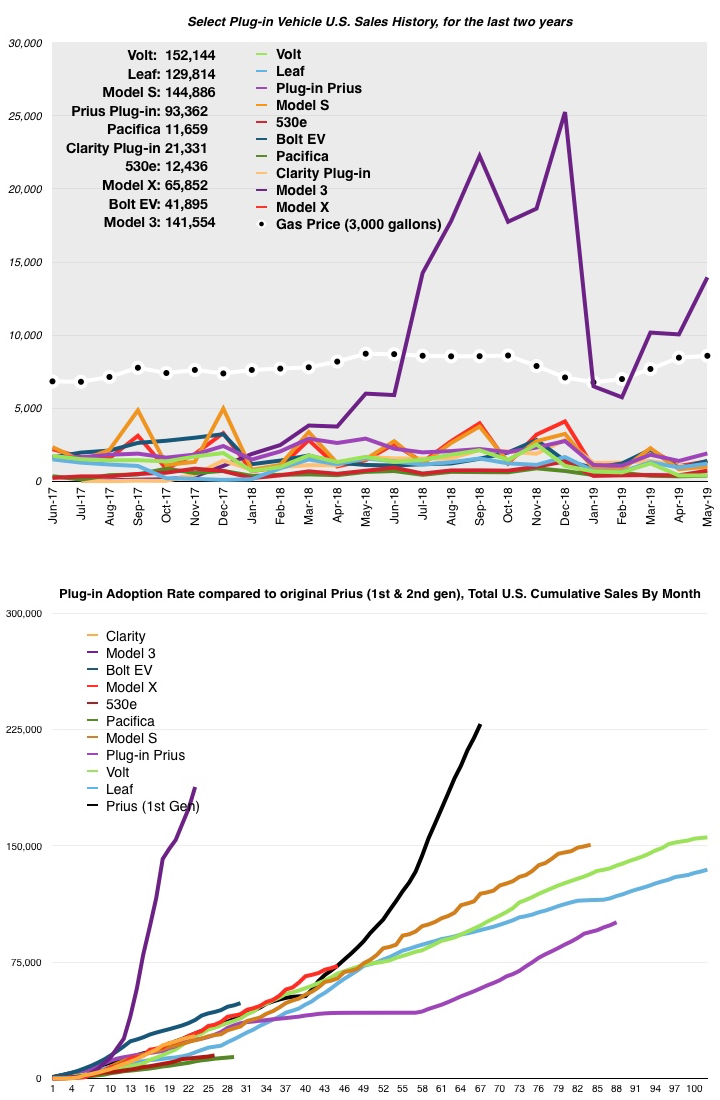

Below, are the May 2019 sales figures, compared to the previous month. Their sales were all up, albeit some barely so, except for the Honda Clarity.

- Chevy Volt: UP 1% (408 vs. 405) **estimated

- Chevy Bolt EV: UP 53% (1,396 vs. 910) **estimated

- Nissan Leaf: UP 28% (1,216 vs. 951)

- Plug-in Toyota Prius: UP 37% (1,914 vs. 1,399)

- Tesla Model S: UP 24% (1,025 vs. 825) **estimated

- Tesla Model X: UP 31% (1,375 vs. 1,050) **estimated

- BMW 530e: UP 75% (727 vs. 416)

- Plug-in Chrysler Pacifica: UP 12% (390 vs. 347)

- Honda Clarity BEV & PHEV: DOWN 16% (898 vs. 1,069)

- Tesla Model 3: UP 39% (13,950 vs. 10,050)

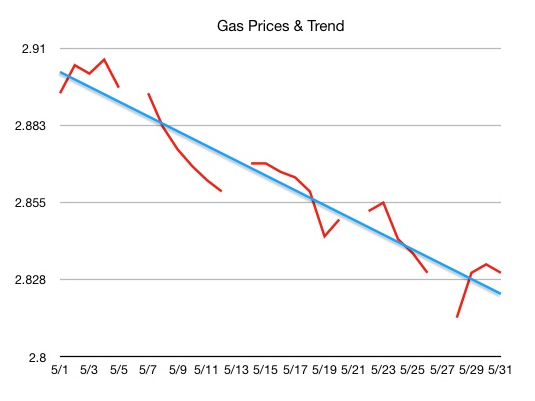

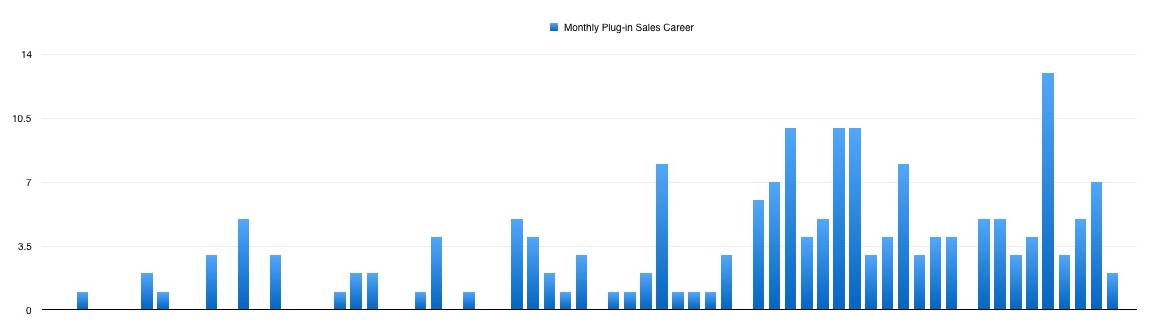

Gasoline prices dropped steadily all month, breaking a five month trend. May gasoline prices started at $2.89 per gallon, and ended 6¢ below the price at which it started, ending at $2.83. My vehicle sales, in May 2019, were abysmal. May ended a six month trend, in which my monthly sales had been above my historical average for that month. May sales were down 37% from my average May sales.

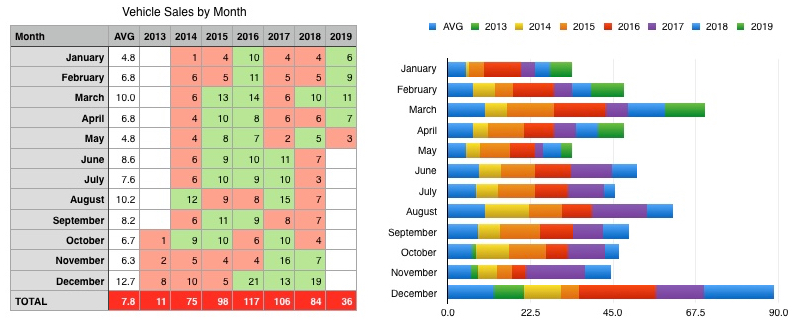

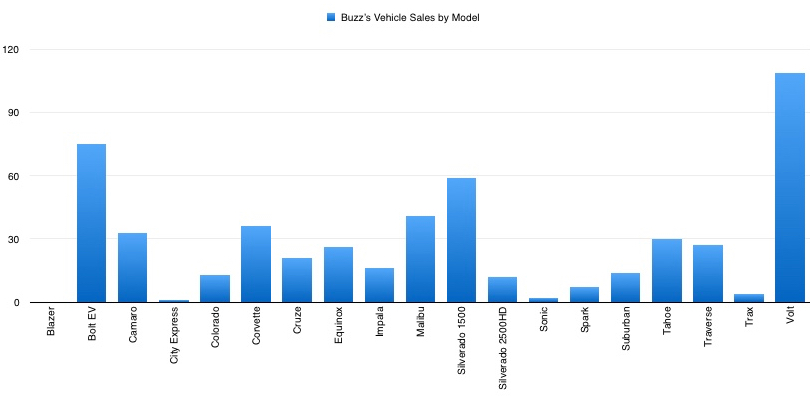

My vehicle sales, in May 2019, were abysmal. May ended a six month trend, in which my monthly sales had been above my historical average for that month. May sales were down 37% from my average May sales. My three April 2019 sales were comprised of a Malibu, a Trax and a Traverse. Bolt EV and Volt still dominate my sales, over my entire tenure here, but last month they were a goose egg.

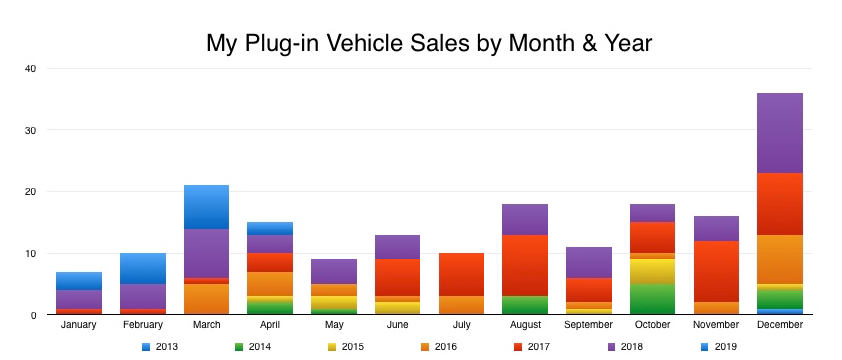

My three April 2019 sales were comprised of a Malibu, a Trax and a Traverse. Bolt EV and Volt still dominate my sales, over my entire tenure here, but last month they were a goose egg. You can see, in the chart below, that the thin blue bar for April is greatly reduced from January, February and March of this year and non-existent for May.

You can see, in the chart below, that the thin blue bar for April is greatly reduced from January, February and March of this year and non-existent for May. To find the last time my plug-in sales were zero, as I mentioned above, was August 2017. I had no inventory then. Before that, you’d have to go back to August 2016. The chart below, looks exactly like last month’s, since the far right entry is zero.

To find the last time my plug-in sales were zero, as I mentioned above, was August 2017. I had no inventory then. Before that, you’d have to go back to August 2016. The chart below, looks exactly like last month’s, since the far right entry is zero. Plug-in sales, compared to the same month a year ago, were mostly down, with two increasing at least 1%. Those were the Bolt EV and the Model 3:

Plug-in sales, compared to the same month a year ago, were mostly down, with two increasing at least 1%. Those were the Bolt EV and the Model 3:

- Chevy Volt: DOWN 76% (408 vs. 1,675)

- Chevy Bolt EV: UP 24% (1,396 vs. 1,125)

- Nissan Leaf: DOWN 23% (1,216 vs. 1,576)

- Plug-in Toyota Prius: DOWN 35% (1,914 vs. 2,924)

- Tesla Model S: DOWN 33% (1,025 vs. 1,520)

- Tesla Model X: DOWN 5% (1,375 vs. 1,450)

- BMW 530e: UNCHANGED (727 vs. 729)

- Plug-in Chrysler Pacifica: DOWN 40% (390 vs. 650)

- Honda Clarity BEV & PHEV: DOWN 46% (898 vs. 1,676)

- Tesla Model 3: UP 133% (13,950 vs. 6,000)

On a final note, a comment on Facebook asked me to comment on where I obtain my sales figures. I use several sources, including InsideEVs, GoodCarBadCar, CarSalesBase and hybridCars.

Owner of a 2015 Volt here. My opinion is that there are multiple factors negatively affecting Bolt and Volt sales. One of course is the halving of the tax credits, but GM incentives have more than made up for that. Chevy discontinuing the Volt, and not replacing it at all, is a huge factor. I always assumed GM’s complete lack of marketing effort behind the Volt was because they were losing money on it, or making very little. However, with the drop in battery costs over the years, I’m not sure that was the case by the time it was discontinued. But, I do think GM’s whole emphasis is on trucks, where they make the bulk of their profits. I’m sure consumers are discouraged by GM’s lack of commitment to the Volt’s electric-gas approach.

Regarding the Bolt, it seems as though GM’s focus is on fleet sales and making the Bolt an autonomous driving vehicle they can sell to the Lyfts and Ubers of the world. Why take away from profitable truck sales by pushing the Bolt to consumers (short sighted in my opinion, but typical Big 3 thinking)?

I love driving an electric vehicle, but I bought a Volt instead of a Bolt so I had the flexibility to take long trips without the need for charging. And I’m glad I did, as our son is using it to drive to Austin weekly this summer for an internship, where he has no access to charging during the week at either his work or his hotel. With the Volt, there is no inconvenience for him. There is still a place for the Volt design, and it is a shame that it will soon no longer be an option at your dealership. I wish you luck!

According to this article, sales of gas cars are down while Tesla sales are up.

https://cleantechnica.com/2019/06/20/yellow-light-in-us-auto-industry-consumer-demand-problem-growing-for-gas-cars/

Texan loves his 2017 Bolt after two years of his lease (but says the seats could be better–not as good as the Volt’s seats):

https://insideevs.com/features/356186/why-i-drive-2017-chevrolet-bolt-ev/

BMW says it will have 25 new “electrified” models on the market by 2023, and that the majority of them will be fully electric.

https://www.greencarreports.com/news/1123785_bmw-pulls-ahead-its-electrification-plans-by-two-years

(I didn’t know BMW had 25 models.)