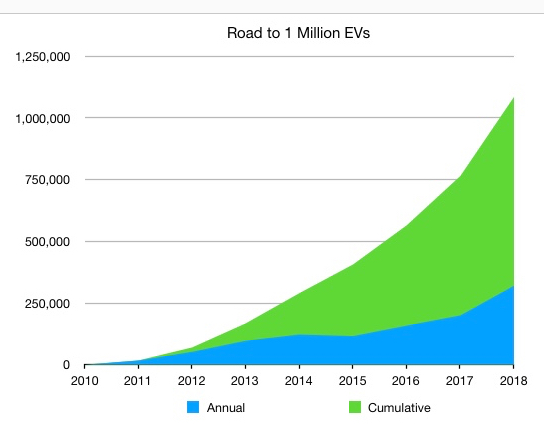

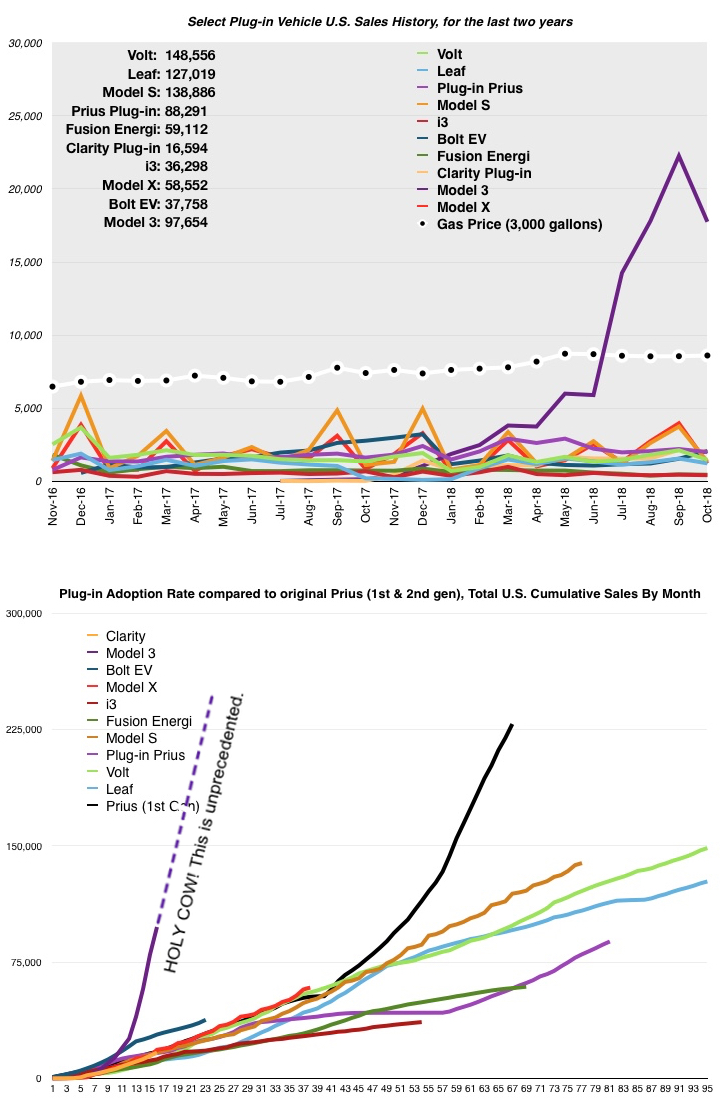

It has since been verified by major media outlets: The 1,000,000th plug-in vehicle, sold in the U.S., was sold in the first few days of September 2018. My current projection for total plug-in vehicles sold in the U.S. is 1,085,005 total by the end of this year (and that’s probably a low estimate). In 2017, there were 199,826 plug-in vehicles sold in the U.S. This year’s annual sales could hit 320,000+, which would be a 60% increase over 2017’s sales numbers. Since their inception in December 2010, U.S. plug-in vehicles sales’ increase/decrease over the previous year looks like this:

- 2012 +196%

- 2013 +85%

- 2014 +26%

- 2015 -5%

- 2016 +37%

- 2017 +26%

- 2018 +60% ???

Tesla Motors’ Model 3 sales eased up a bit, compared to the previous month, but it still experienced the third-best plug-in vehicle monthly sales figure to date.

Tesla Motors’ Model 3 sales eased up a bit, compared to the previous month, but it still experienced the third-best plug-in vehicle monthly sales figure to date.

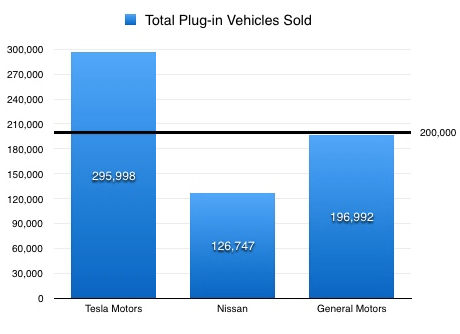

Tesla hit the 200,000th EV sale, near the end of June this year and they’re already, just 3 months later at almost 300,000 (just missing that mark by 4,002 EVs).

GM, still seems to be slowing down deliveries of Volts and Bolt EVs. Classic Chevrolet (the dealership at which I work) has fourteen Bolt EVs, that have been built for customers, which are languishing in a rail yard in Ohio or at the factory in Orion Township. A couple have been there for eight weeks already. The three 2019 Volts we have ordered, aren’t scheduled to be built until the last couple weeks of this year. GM has publicly announced that GM’s 200,000th plug-in vehicle will be sold next month, so I doubt the slow shipping is a numbers game. I believe GM will hit the 200,000th this month, IF they get the shipping times back to normal. Paradoxically, I’ve heard that the CARB states are having no trouble getting as many Bolt EVs & Volts as they want…

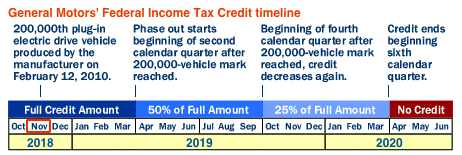

GM has publicly announced that GM’s 200,000th plug-in vehicle will be sold next month, so I doubt the slow shipping is a numbers game. I believe GM will hit the 200,000th this month, IF they get the shipping times back to normal. Paradoxically, I’ve heard that the CARB states are having no trouble getting as many Bolt EVs & Volts as they want… Once GM hits the 200K sales mark, here’s how the phaseout would occur:

Once GM hits the 200K sales mark, here’s how the phaseout would occur:

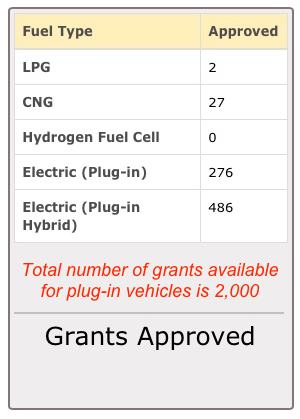

Another item of interest, for residents of Texas, is the number of plug-in vehicle grants that have been handed out. The limit was set at $5M, or 2,000 grants. As of this morning, 762 of the rebates have been issued. That’s 38% of the available grants and an increase of 186 EVs and PHEVs, over the last month.

Notice the high purple line, in the chart below, at the far right side of the graph. That’s the Model 3 sales curve. Although sales are down, when compared to last month, it’s still the 3rd best sales month of any plug-in vehicle. Ever. Here are the August 2018 sales figures, compared to the previous month. This month all but one vehicle I track showed lower sales, over the previous month:

Here are the August 2018 sales figures, compared to the previous month. This month all but one vehicle I track showed lower sales, over the previous month:

- Chevy Volt: DOWN 31% (1,475 vs. 2,129) **estimated

- Chevy Bolt EV: UP 34% (2,075 vs. 1,549) **estimated

- Nissan Leaf:DOWN 21% (1,234 vs. 1,563)

- Plug-in Toyota Prius:DOWN 10% (2,001 vs. 2,213)

- Tesla Model S: DOWN 64% (1,350 vs. 3,750) **estimated

- Tesla Model X:DOWN 67% (1,225 vs. 3,975) **estimated

- BMW i3:DOWN 8% (424 vs. 461)

- Ford Fusion Energi:DOWN 6% (453 vs. 480)

- Honda Clarity BEV & PHEV:DOWN 5% (2,051 vs. 2,150)

- Tesla Model 3:DOWN 20% (17,750 vs. 22,250)

Reversing the trend we’ve seen lately, in August, the average price of gasoline trended downward all month. It started at $2.906 per gallon and rose ever so slightly, for two days. From that point on, the price steadily fell.

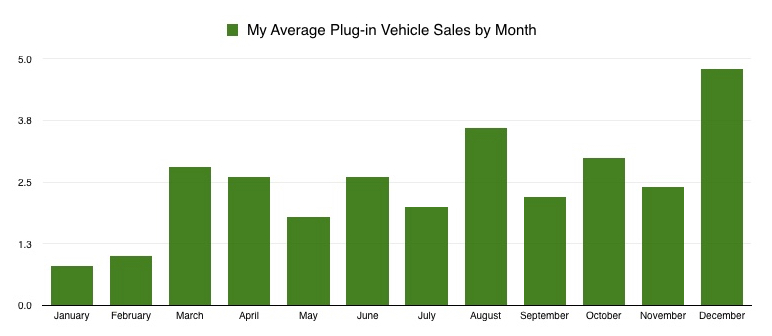

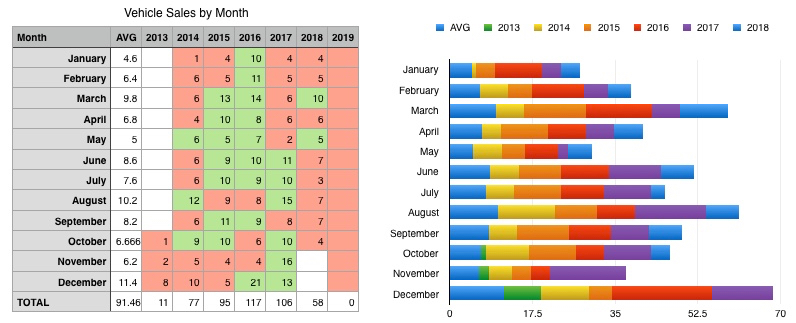

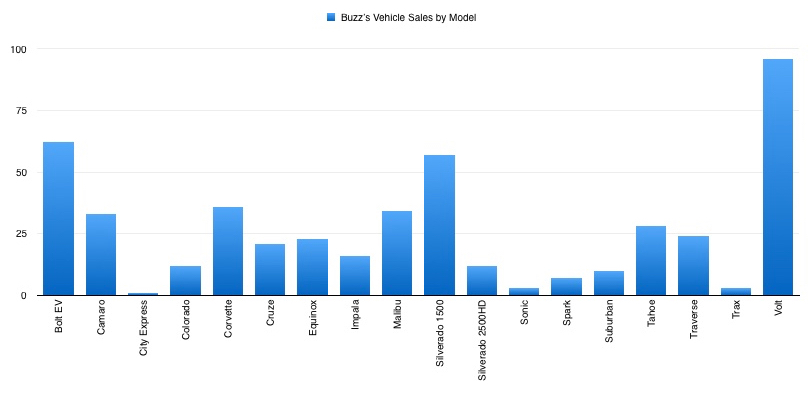

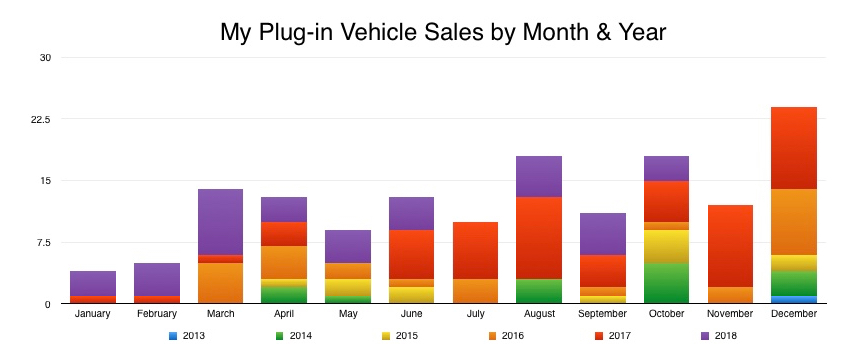

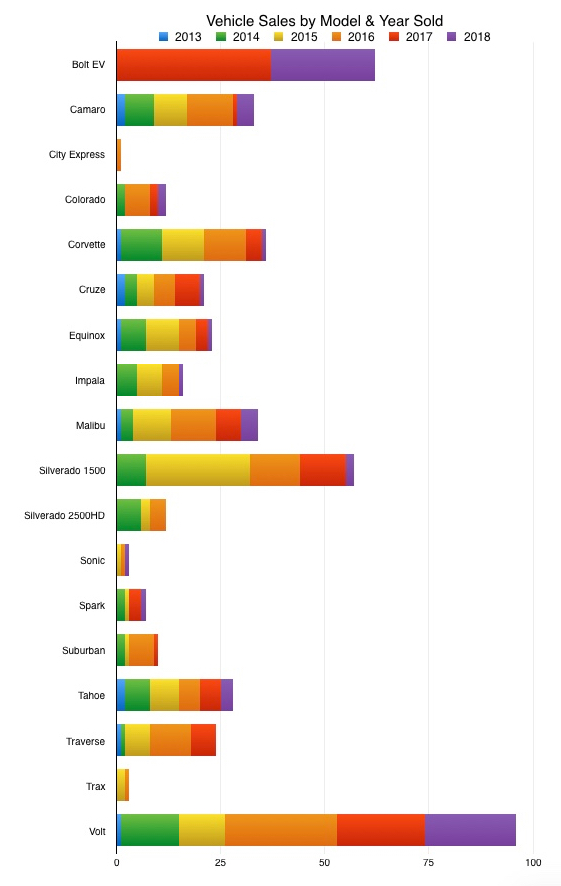

My vehicle sales, in October 2018, continued to struggle. October sales are usually a little lower than September. In September, I was at 85% of my usual September sales volume. In October, I was at 60% of my usual October sales. My four October 2018 sales were comprised of two Bolt EVs, one Volt (which I leased to myself), and a Camaro. My lifetime Volt sales now total 96. If I haven’t had my 100th Volt sale before the end of the year, I’ll be stunned.

My four October 2018 sales were comprised of two Bolt EVs, one Volt (which I leased to myself), and a Camaro. My lifetime Volt sales now total 96. If I haven’t had my 100th Volt sale before the end of the year, I’ll be stunned. My 2018 plug-in sales, have rebounded, after a miserable July. Even with three plug-ins sold in October, it was a sub-par plug-in sales month.

My 2018 plug-in sales, have rebounded, after a miserable July. Even with three plug-ins sold in October, it was a sub-par plug-in sales month. As I mentioned last month, July was my worst month, in total sales, since January 2014, which was only my 4th month in auto sales. The July plug-in sales problem was lack of inventory.

As I mentioned last month, July was my worst month, in total sales, since January 2014, which was only my 4th month in auto sales. The July plug-in sales problem was lack of inventory. Plug-in sales, compared to the same month a year ago, were mostly up. The lowered sales were for the Bolt EV, due to constrained inventory, the Model S, the BMW i3 and the Ford Fusion Energi. Three of these were in the same category last month.

Plug-in sales, compared to the same month a year ago, were mostly up. The lowered sales were for the Bolt EV, due to constrained inventory, the Model S, the BMW i3 and the Ford Fusion Energi. Three of these were in the same category last month.

- Chevy Volt: UP 8% (1,475 vs. 1,362)

- Chevy Bolt EV: DOWN 25% (2,075 vs. 2,781) **became available nationwide in September 2017 and had considerable pent-up demand

- Nissan Leaf: UP 479% (1,234 vs. 213)

- Plug-in Toyota Prius: UP 23% (2,001 vs. 1,626)

- Tesla Model S: UP 21% (1,350 vs. 1,120)

- Tesla Model X: UP 44% (1,225 vs. 850)

- BMW i3: DOWN 38% (424 vs. 686)

- Ford Fusion Energi: DOWN 39% (453 vs. 741)

- Honda Clarity BEV & PHEV: UP 4,134% (2,051 vs. 34) **Clarity debuted in July 2017

- Tesla Model 3: UP 12,141% (17750 vs. 145) **Model 3 debuted in July 2017

One note on the Clarity & Model 3: October 2018 was compared with only the fourth month of these vehicles’ availability, and they really didn’t sell in volume until December. Due to that, the percentages are more skewed than if they had a “normal” month’s volume to compare to. The Nissan Leaf, in October 2017, was beginning a long, slow wind-down of the first generation Leaf.

On a final note, a comment on Facebook asked me to comment on where I obtain my sales figures. I use several sources, including InsideEVs, GoodCarBadCar, CarSalesBase and hybridCars.

I found an article which explains why legacy automakers aren’t pushing their EV products with aggressive ad campaigns, a question I think I posed to you, Buzz.

“[B]y nature of being a mature player in a mature market, [GM may] have experienced all of the significant growth that they are ever going to.” In fact, “legacy automakers must undertake [significant] R&D simply to maintain current revenue streams. Between 2013 and 2017, GM spent a combined $36bn in R&D yet revenue declined from $155bn to $145bn. Over the same period, Tesla spent a combined $3.7bn in R&D, but revenues grew from $2bn to $11.7bn.”

“While some of GM’s R&D efforts went to EVs, some (likely) went to improving internal combustion engine tech. And looking ahead, ‘shifting the focus to EVs, GM will render their current factories, production lines, patents, designs — anything that specifically relates to ICE products and production — either partly or fully redundant.’ Some of those assets could become liabilities [or worthless].”

” ‘EV sales will simply cannibalize and replace ICE vehicle sales.’ At this stage in their business lifecycle, GM must, therefore, undertake all of these additional challenges and expenditures knowing full well that [short term] revenues will not grow by any significant amount.’ ”

” ‘GM has little incentive to rapidly transition to EV manufacturing and would rather stave it off as long as possible … regardless of it being widely accepted as the socially responsible thing to do. . . . [P]rofits often trump ethics.’ ”

https://cleantechnica.com/2018/11/08/big-auto-has-a-problem-evolve-too-slowly-or-cannibalize-cash-cows/

Unfortunately, the stock market only rewards current quarter results, instead of long-term planning.

When our economic system threatens the existence of life on the planet, reasonable people would call it a disaster.

Weren’t we all raised to believe that in our great capitalistic system companies responded to consumer demand, i.e. that they made what consumers wanted? Evidently, that was a crock.

“[T]he Model 3 was the top selling car in terms of revenue among ALL cars, not just electric vehicles. All told, Tesla delivered 55,840 Model 3s in the third quarter — and that’s just in North America, just for cash or loan (no leases yet), and it still isn’t available in the promised $35,000 version, with the most affordable option today being a Limited Edition Mid-Range (aka the LEMuR) version that comes at a base price of $47,000.”

Consumers want electric cars, but executives at the legacy auto companies care more for their stock options and short term profits than what consumers want.

Capitalist economies have a tough time with disruption and responsibility. Capitalists are just interested in building capital. If the development costs are low enough, they will forge new markets or new technologies, discarding older, established products. (Airplanes, cellular phones -> smart phones). However, is an established, profitable product has a problem, (tobacco, coal or oil) that cannot be solved, they attempt to protect the product/brand. They’ll hire experts to dispute claims and confuse the political discourse. If an entrepreneur invents a new product that will threaten their product’s ecosystem, established companies may decide to buy the rights and shelve the development, until they can’t move their product forward any further. Sometimes (and my conservative friends seem to hate this) the government has to support a fledgling industry, due to its development cost/complexity/utility. The Internet started out in the Defense Advanced Research Projects Administration (DARPA) as Arpanet. Today, it’s a tool most of us could not function without. Government incentives to install solar panels or buy electric vehicles is a way to help established businesses move into a future technology that is necessary for the public good. However, due to the way we treat the stock market as a gambling hall, executives and their companies are judged based on this quarter’s results in comparison to previous quarters. It’s hard for an executive to support a product that will generate losses if it means moving away from products that contribute mightily to the company’s bottom line and stock value.

I’m not saying this is good. It’s just the way it is…until someone changes it.

Well said, Buzz.

VW may be an exception among legacy car makers. VW claims it plans to manufacture 50 (!) new electric vehicles by 2025. It has added a budget of another $11 billion between now and 2023 to bring its total EV investment up to $50 billion.

In other words, it sounds like VW has decided to go all in on EVs, the short term consequences be damned.

One pundit says, “VW Group as a whole — arguably above any other automaker — has the finances, resources, and capacity to pull this off with ease.”