I often hear, as a potential objection to getting a plug-in vehicle, that they depreciate too quickly, when compared to gasoline-powered vehicles. I’ve been scanning used car prices, for the Chevy Volt, in Texas to try to evaluate this.

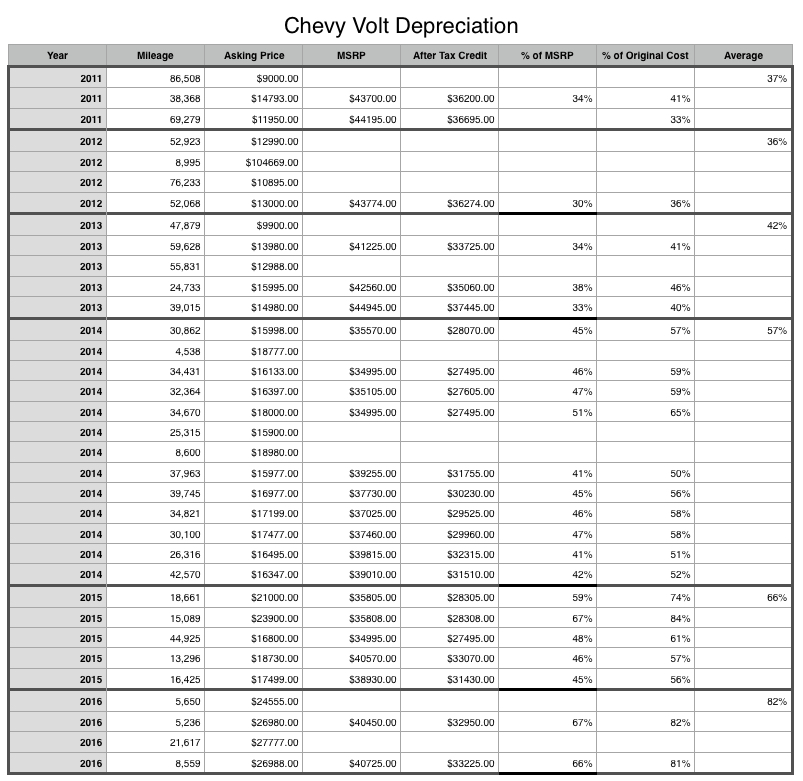

Of course, I built a spreadsheet, as I am a former manufacturing engineer and am a confirmed EV nerd. I pulled every invoice I could, by using the used Volts’ vehicle identification number, or VIN, to access the original invoice. Of course, I do not know what the original buyer paid for the Volt, so I used MSRP. I also do not know what a buyer will offer on the used car purchase, so I used the advertised price for the current value.

The original invoice, in some cases, could not be located. The newer the model, the better the chance I could locate the invoice. Also, I was only able to locate 34 pre-owned Volts, within 250 miles of my location, so the sample is fairly small. That being said, the percentage of MSRP that the asking price represents was pretty consistent in my sampling.

What I’ve found, is that when you take into account the Federal Income Tax Credit at its full value of $7,500, the depreciation appears to be very close to other vehicles. It is true that not everyone qualifies for the full $7,500, and those who lease do not get the credit. In the case of leasing, the leasing company gets the tax credit. However, leasing incentives put most of the tax credit back into the lease, to lower the monthly payment. For instance, this month, the leasing incentives start at $5,025.

Here’s the spreadsheet: I noticed that the 2014 vehicles, now three years old, have only depreciated 43%, whereas I expect most vehicles to depreciate 50% over three years, once the tax credit is taken into account. This may be optimistic asking prices or because this sampling seems to have low mileage per year. In any case, I am not trying to say Volts depreciate at a slower rate than other vehicles, just that they don’t depreciate faster than traditional vehicles. One interesting note: There was a $5,000 price drop on Volts, going into the 2013 model year. This should have had a disastrous effect on depreciation of the earlier model years. Based on the scanty evidence I could find, this did not seem to be the case.

I noticed that the 2014 vehicles, now three years old, have only depreciated 43%, whereas I expect most vehicles to depreciate 50% over three years, once the tax credit is taken into account. This may be optimistic asking prices or because this sampling seems to have low mileage per year. In any case, I am not trying to say Volts depreciate at a slower rate than other vehicles, just that they don’t depreciate faster than traditional vehicles. One interesting note: There was a $5,000 price drop on Volts, going into the 2013 model year. This should have had a disastrous effect on depreciation of the earlier model years. Based on the scanty evidence I could find, this did not seem to be the case.

As the disclaimer goes: “Past performance is not a guarantee of future performance.” The Bolt EV may have an impact on Volt resale values, going forward. Only time will tell. For that reason, I recommend my Volt clients lease instead of purchase their Volt. There are actually several reasons why I do this:

- New, long range EVs (like Bolt) may hurt resale value.

- Those who do not qualify for the entire tax credit, due to low tax burden (retirees and young buyers), will get better value by leasing and the leasing incentives.

- Advancements in battery technology and faster charging will make today’s plug-in vehicles seem like antiques, for those of us who’ve been driving them for a few years. By leasing, we a future-proofing our EV experience by being able to move into the next generation of plug-ins more quickly.

- The return of lease vehicles creates a market for preowned plug-in vehicles. This helps lower income buyers join in the transportation revolution. Although those of us with EV experience may want the latest and greatest, those new to these wonderful vehicles will still feel like they’ve stepped into a brighter future because, even a three year old plug-in vehicle seems like such an advancement over internal combustion engine (ICE) technology.

Of all of these reasons, it’s the last one that is most important to me. Once someone gets their first plug-in vehicle and enjoys the silence of electric drive, the exhilarating acceleration and the convenience of refueling at home or parked at work, the odds they’ll return to an ICE vehicle is negligible. This effect is called “butts in seats.” Until one experiences these things first-hand, they just don’t get it. In my day job as an EVangelist, I insist the EV curious go on a test drive. I tell them right up front, “No matter what I tell you, you won’t really understand, until you drive an EV.”

That’s what will accelerate the move forward, toward the future of electric transportation.

GREAT post!!! Our 2014 is 3 years old later this month, with just over 20,000 miles. We have one more year to go on our Ally lease (11 payments). How many payments do you think they will “forgive” if we lease another Volt? How long does it take for delivery of a Volt, if we ORDER one from the factory? (We really want adaptive cruise and full emergency stopping, and even the high-end Volts in Las Vegas don’t come so equipped.) The goal: The new Volt we want at the right time for Ally to forgive and offer a new lease. Is that doable?

IF GM runs a “lease pull-ahead” incentive it is usually the lesser of the following values 1) $1,500 or 2) your last 4 lease payments. DFW International Airport is about 10 minutes from my dealership. I’d be happy to pick you up and bring you in. I’d enjoy waving as you drive off into the sunset!

Left out of these equations seems is TCO. Considering that the engine is rarely used, and that I drive in ‘L’ to use the regenerative braking as much as possible, it seems reasonable to suggest that TCO will be drastically lower due to minimal maintenance. The wear item will be tires. I’d like to see stats on when Chevy is seeing these vehicles come in for brake jobs vs. gas powered vehicles of the same size.

Also, in some states and local areas, the rebates are higher. In Kern County CA, you get an additional $3k rebate, along with the $2500 rebate for EVs. PHEVS are a little less.

In this case, all the vehicles were in Texas. Some of them benefitted from the $2,500 Texas Rebate (which was discontinued).

As to your last and best reason: It was a consideration for me, too, but I have found that smart EVs just disappear when their leases are done. Mercedes Benz won’t extend leases and the leases are such a bargain that the residual value is too high to buy at the end of the lease – so many 2014 smarts and some 2015 should be off lease in the used market, but they’re not. The only ones around are very low mileage – so not off lease. Any idea what happens to them? Do they go overseas?

Used Volts are pretty rare around here. I’ve wondered if someone has a transport truck and is shipping to areas, like California, to sell them in a better market. CA residents will by a plug-in hybrid or EV solely to get what we Texans call a High Occupancy Vehicle (HOV) lane pass.

I’ve lease the last 2 PHEV’s, a 2013 Volt and 2014 Ford Fusion Energi. I’m completely “sold” on the Volt and will likely go back to one when the Ford lease is up but here in Texas, there’s a problem in that the state taxes you for the full value of the vehicle up front, not monthly like many states. When I got my Ford, I actually avoided the bulk of that via a program that the Ford dealer participates in that pays the bulk of that tax. (It’s called “Lenders and Members” or “L&M” for short) I wish Chevy dealers had a similar thing.

Great post. Very informative. Thanks