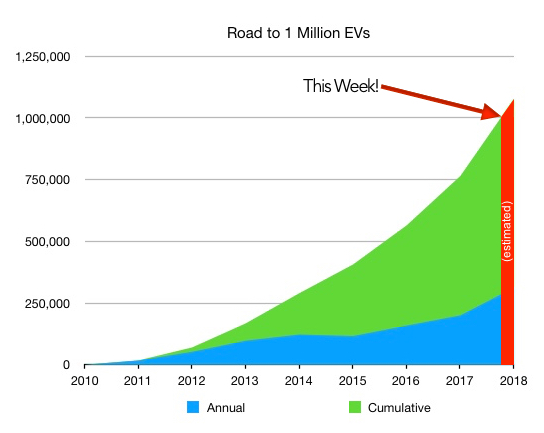

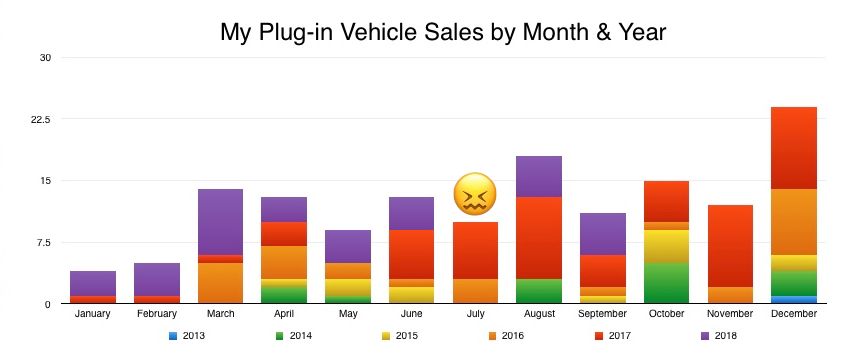

It appears that the 1,000,000th plug-in vehicle, sold in the U.S., was sold in the first few days of THIS MONTH. Yes, I believe that this has already occurred. The goal President Obama set for the nation, has more than likely been achieved and we will probably see 100,000 more sold before the year ends. Tesla Motors’ Model 3 sales continue to amaze. In July, Tesla sold an amazing 14,250 copies of the Model 3. In August, they sold 17,800. Last month, sales jumped up again, with 22,250 units sold! To see how different the Model 3’s success has been, take a look at the “Sales History” graph below. Then, look at the same graph from April or May of this year. The variations of Model S and Model X sales, in the earlier months, dominated the old graphs. Now, all other plug-in vehicle sales curves are smashed down to the bottom of the graph, due to the scaling caused by the Model 3 sales.

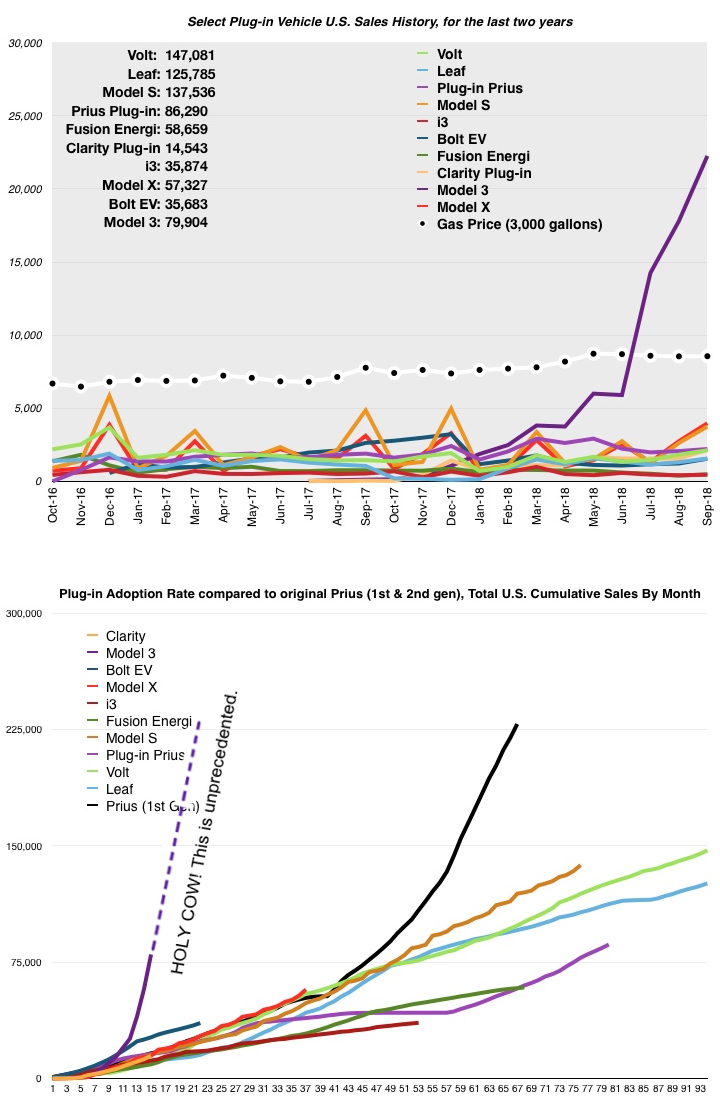

Tesla Motors’ Model 3 sales continue to amaze. In July, Tesla sold an amazing 14,250 copies of the Model 3. In August, they sold 17,800. Last month, sales jumped up again, with 22,250 units sold! To see how different the Model 3’s success has been, take a look at the “Sales History” graph below. Then, look at the same graph from April or May of this year. The variations of Model S and Model X sales, in the earlier months, dominated the old graphs. Now, all other plug-in vehicle sales curves are smashed down to the bottom of the graph, due to the scaling caused by the Model 3 sales.

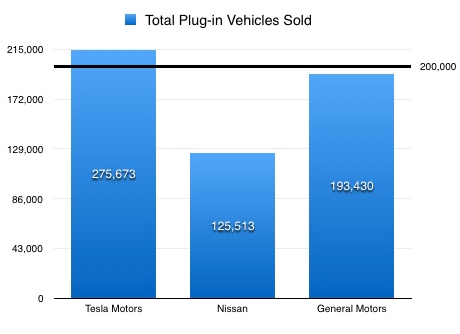

Tesla hit the 200,000th EV sale, in June of this year and they’re already, just 3 months later over 275,000.

There have been posts, in social media, that show Tesla customers have started to volunteer to introduce new Tesla owners to their vehicles, when purchased. In the industry, the process of handing over a vehicle to the new buyer is called “delivering” the vehicle (even though 99.9% of the time, it occurs at the dealership). Delivery technique varies greatly, with some salespeople teaching the new buyer a great deal about operation of their new car. This is something on which I spend a great deal of time and effort, especially with my plug-in vehicle buyers. I’ve also known salespeople to hand the buyer their new keys and say, “Thanks for your purchase. Here’s your keys. The owner’s manual is in the glovebox.”

In my opinion, the lack of a dealer network will strain Tesla, when it comes to delivering as many Model 3s as they are now. The “Seeking Alpha” website published an article, asking if this issue is Tesla’s “Achilles’ heel.” In all fairness to Tesla, Seeking Alpha has published at least four other articles asking if other issues were Tesla’s Achilles’ heel… Although vehicles may easily be sold by the Tesla model of stores, modeled after the Apple Store, for education, delivery and service, the scale required by the Model 3 sales volume, is another matter entirely. To compete in the mass-production market, I think a crossroad is approaching where Tesla must decide between quality of customer experience and establishing a dealership network.

GM, on the other hand, seems to be slowing down deliveries of Volts and Bolt EVs. Classic Chevrolet (the dealership at which I work) has eight Bolt EVs, that have been built for customers, which are languishing in a rail yard in Ohio. A couple have been there for four weeks already. Possibly, there is a plan in place to keep from selling the 200,000th plug-in, until after December 31st. I certainly hope that is not the case, but looking at last month’s sales numbers, it appears that GM will be well into December, before the 200,000th sale. Of course, this trickling in of inventory is not a good way to get salespeople interested in investing their time in plug-in vehicle sales…

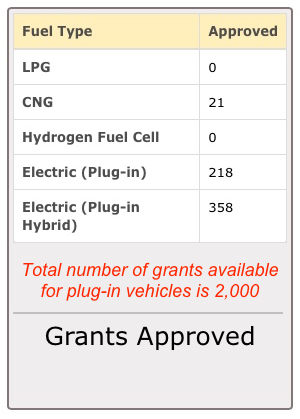

Another item of interest, for residents of Texas, is the number of plug-in vehicle grants that have been handed out. The limit was set at $5M, or 2,000 grants. As of this morning, 576 of the rebates have been issued. That’s 29% of the available grants and an increase of 150 EVs and PHEVs, over the last month.

Another item of interest, for residents of Texas, is the number of plug-in vehicle grants that have been handed out. The limit was set at $5M, or 2,000 grants. As of this morning, 576 of the rebates have been issued. That’s 29% of the available grants and an increase of 150 EVs and PHEVs, over the last month.

Notice the high purple line, in the chart below, at the far right side of the graph. That’s the Model 3 sales curve. all the other plug-in vehicles I track, including the other Tesla models are smashed down at the bottom of the graph. The adoption rate chart, below the sales history chart, shows just how unprecedented the Model 3’s adoption rate is. Here are the August 2018 sales figures, compared to the previous month. This month every single vehicle I track showed improved sales, over the previous month:

Here are the August 2018 sales figures, compared to the previous month. This month every single vehicle I track showed improved sales, over the previous month:

- Chevy Volt: UP 17% (2,129 vs. 1,825) **estimated

- Chevy Bolt EV: UP 26% (1,549 vs. 1,225) **estimated

- Nissan Leaf: UP 19% (1,563 vs. 1,315)

- Plug-in Toyota Prius: UP 7% (2,213 vs. 2,071)

- Tesla Model S: UP 43% (3,750 vs. 2,625) **estimated

- Tesla Model X: UP 45% (3,975 vs. 2,750) **estimated

- BMW i3: UP 10% (461 vs. 418)

- Ford Fusion Energi: UP 21% (480 vs. 396)

- Honda Clarity BEV & PHEV: UP 37% (2,150 vs. 1,570)

- Tesla Model 3: UP 25% (22,250 vs. 17,800)

Reversing the trend we’ve seen lately, in August, the average price of gasoline bounced around, trending back up, overall. It started at $2.83 per gallon and dropped for two days. Over a Sunday, the price jumped up by almost 3.5 cents. After this, it just bounced up and down, until the last week of the month, when it topped out at $2.88, before dropping to $2.87 at the end of the month.

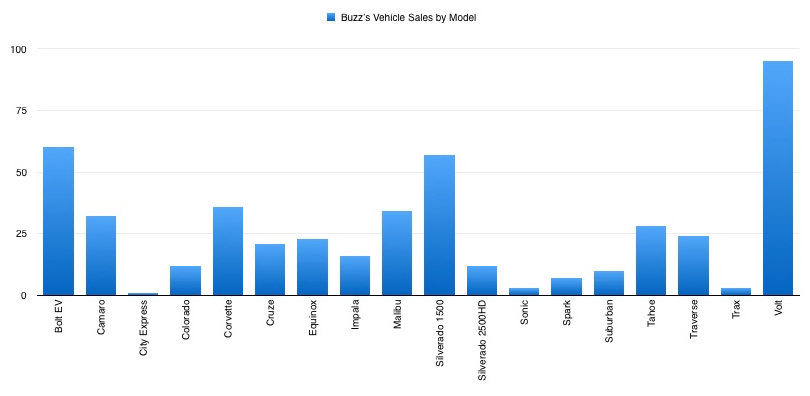

My vehicle sales, in September 2018, started to return closer to my historical average. September sales are usually a little lower than August. The kids go back to school. Summer comes to an end. In August, I was at only 64% of my usual August sales. In September, I was at 82% of my usual September sales. I am definitely seeing lower sales volume and traffic this year. Are consumers worried about something? Are you? My seven September 2018 sales were comprised of three Bolt EVs, two Volts, a ZL1 Camaro and a Malibu. I have to admit, that ZL1 was beautiful… With no Silverado 1500s in the mix, my 2nd best-selling vehicle is now firmly established as the Bolt EV. I expect that to continue, as I have several Bolt EVs on order for clients.

My seven September 2018 sales were comprised of three Bolt EVs, two Volts, a ZL1 Camaro and a Malibu. I have to admit, that ZL1 was beautiful… With no Silverado 1500s in the mix, my 2nd best-selling vehicle is now firmly established as the Bolt EV. I expect that to continue, as I have several Bolt EVs on order for clients. My 2018 plug-in sales, have rebounded, after a miserable July. As I mentioned last month, July was my worst month, in total sales, since January 2014, which was only my 4th month in auto sales. The July plug-in sales problem was lack of inventory.

My 2018 plug-in sales, have rebounded, after a miserable July. As I mentioned last month, July was my worst month, in total sales, since January 2014, which was only my 4th month in auto sales. The July plug-in sales problem was lack of inventory. Plug-in sales, compared to the same month a year ago, were mostly up. The lowered sales were for the Bolt EV, due to constrained inventory, the Model S, the BMW i3 and the Ford Fusion Energi. Three of these were in the same category last month.

Plug-in sales, compared to the same month a year ago, were mostly up. The lowered sales were for the Bolt EV, due to constrained inventory, the Model S, the BMW i3 and the Ford Fusion Energi. Three of these were in the same category last month.

- Chevy Volt: UP 47% (2,129 vs. 1,453)

- Chevy Bolt EV: DOWN 41% (1,549 vs. 2,632) **became available nationwide in September 2017 and had considerable pent-up demand

- Nissan Leaf: UP 48% (1,563 vs. 1,055)

- Plug-in Toyota Prius: UP 17% (2,213 vs.1,899)

- Tesla Model S: DOWN 23% (3,750 vs. 4,860)

- Tesla Model X: UP 27% (3,975 vs. 3,120)

- BMW i3: DOWN 14% (461 vs. 538)

- Ford Fusion Energi: DOWN 37% (480 vs. 763)

- Honda Clarity BEV & PHEV: UP 4,134% (2,150 vs. 52) **Clarity debuted in July 2017

- Tesla Model 3: UP 19,017% (22,250 vs. 117) **Model 3 debuted in July 2017

One note on the Clarity & Model 3: September 2018 was compared with only the third month of these vehicles’ availability, and they really didn’t sell in volume until December. Due to that, the percentages are more skewed than if they had a “normal” month’s volume to compare to.

On a final note, a comment on Facebook asked me to comment on where I obtain my sales figures. I use several sources, including InsideEVs, GoodCarBadCar, CarSalesBase and hybridCars.

“The Tesla Model 3 was the #1 top selling American car in September.”

https://cleantechnica.com/2018/10/08/tesla-model-3-is-1-top-selling-american-car-in-usa/

Imagine how many EVs would be sold if there were advertising campaigns for them.

According to Klaus Frölich, the 58-year-old BMW board member in charge of development, electric vehicles will always be more costly than gas-burners.

“It’s very simple,” says Frölich. In EVs with 90 to 100kWh battery packs, the cell cost alone will be $17,000 to $25,000 (AUD). Frölich doesn’t buy into the theory that when batteries are being produced in larger numbers, prices will fall, alleging certain materials in batteries may become more expensive.

Could Frölich possibly be right about battery costs? (Hope not.)

It would be shortsighted to believe that the battery technology in use now will be the only technology deployed. Back when I was in manufacturing, in the late 1970’s, I made the prediction that video cassette recorders would never be priced below some arbitrary number. I cannot remember now, if it was $500 or $200. I believed the complexity of the mechanism and the sheer number of components made it impossible. However, just before their demise, it was fairly common to find VCRs in the $80 range and those were far more sophisticated than the ones I bought in the 70s.

Regarding all the Bolts piling up in Ohio, this article suggests it’s an ongoing railcar shortage that’s partly to blame. The article also includes charts with actually order-to-deliver times for a lot of specific models including the Bolt EV, which they say is averaging 72 days from the day of order to arrival at the dealer in 2018. So those Bolts may be parked in Ohio for another month… https://www.automotive-fleet.com/314485/demand-for-trucks-and-vans-slow-2018-my-otd

“You’re KILLING me, Smalls!!!!” :-O