********** ATTENTION! **********

TEXAS LEGISLATIVE ALERT REGARDING ELECTRIC VEHICLES AND HYBRID VEHICLES

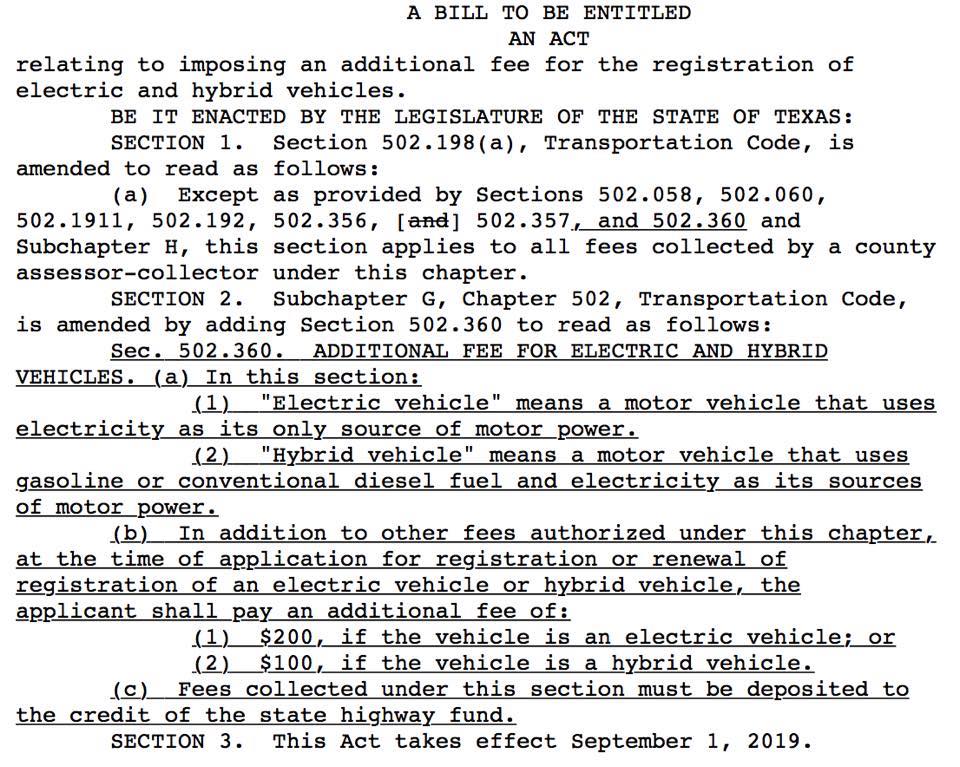

HB 1971/King – Imposing $200 Annual Fee on electric vehicles and $100 on Hybrids.

HB 1971/King – Imposing $200 Annual Fee on electric vehicles and $100 on Hybrids.

PUBLIC HEARING – House Transportation Committee

WHEN: Tuesday, March 26th, 2 PM.

WHERE: Reagan Building, 1400 Congress Ave, Room 120 (Corner of 15th Street & Congress)

Important: Politeness and Respect are key elements of registering opinions to legislators. Please keep this in mind.

EV owners want to pay their fair share of road and bridge taxes.

Currently, gasoline-powered vehicles pay by weight calculation.

Several EV fee bills would charge EV drivers more than a pick-up truck!

Background:

Texans pay 20¢ per gallon in gas taxes, of which 15¢ goes to road and bridge maintenance and 5¢ goes to schools. Battery Electric vehicles don’t run on gasoline, so their owners do not contribute to Texas road and bridge taxes. (They DO pay higher sales taxes when purchasing EVs, as well as taxes on the electricity used to charge their vehicles.) However, EV Owners want to pay their fair share of taxes to support road and bridge maintenance. Fees on gasoline-powered cars are based on the weight of the vehicle. For example, a Chevy Bolt weighs about 3800 lbs. – as much as a Chevy Impala (a full-sized car), which pays $63 in gas taxes per 10,000 miles, according to the Texas Transportation Institute.

Problem:

HB 1971 by Representative King would impose a fee of $200 annual registration fee on all-electric vehicles and $100 on hybrid models. This amount is too high and would be a disincentive to buy an electric vehicle.

Solution(s):

The fee should be equivalent to the average tax gas tax revenue generated by a vehicle of similar size, weight or MPG.

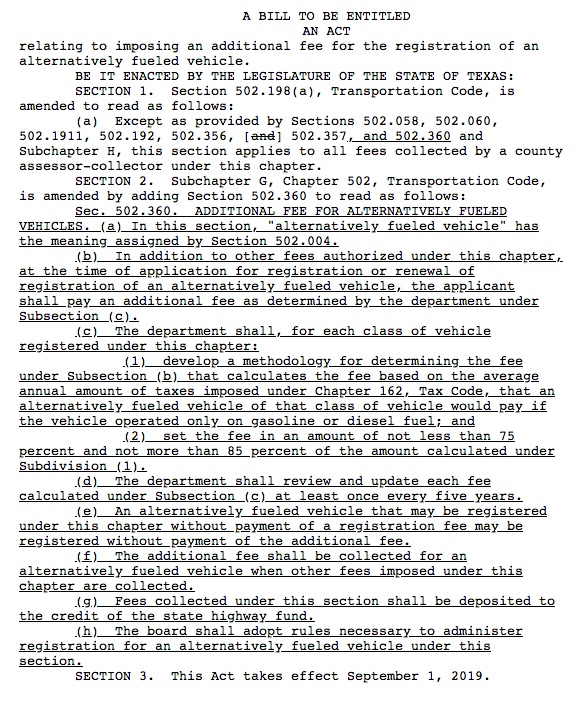

TxETRA supports HB 4218 by Representative Israel, which proposes the Department of Motor Vehicles calculate a fee based on not less than 75% and not more than 85% of the average annual amount of taxes imposed on a traditionally fueled vehicle.

To register your opinion: contact House Transportation Committee Members. Remember that when you expressly share your opinion with Legislators who represent your district, it has an added effect. Below is a committee list-at-a-glance with the city/area each represents. (click the link below)

https://house.texas.gov/committees/committee/?committee=C470

ONCE AGAIN, I IMPLORE YOU, IF YOU DRIVE A PLUG-IN VEHICLE AND LIVE IN TEXAS, PLEASE JOIN TxETRA! They’re your voice in Texas!

As a PHEV driver for the past ~7 years, I am in full support of paying for my share of the road maintenance. My preference, though, would be a complete shift from fuel taxes to a mileage calculation. I’m not sure if weight should play into it as we all benefit from the 18-wheelers use of the roads to bring us our goods.

For Texas registrations, mileage would be trivial to collect at inspection time.

The only problem I see with this kind of plan is that intra-state hauling with trucks registered elsewhere would pay nothing into Texas for these road funds. Possibly some kind of federal funding would need to be in place to cover such commercial hauling?

Agree

Failed to affirm…

https://capitol.texas.gov/BillLookup/History.aspx?LegSess=86R&Bill=HB1971

HB1971 Failed again on May 1st 🙂