Tired of hearing announcements about the latest $80K+ electric vehicle? I know I am!

Here’s something EVERYONE shopping for a new vehicle should know:

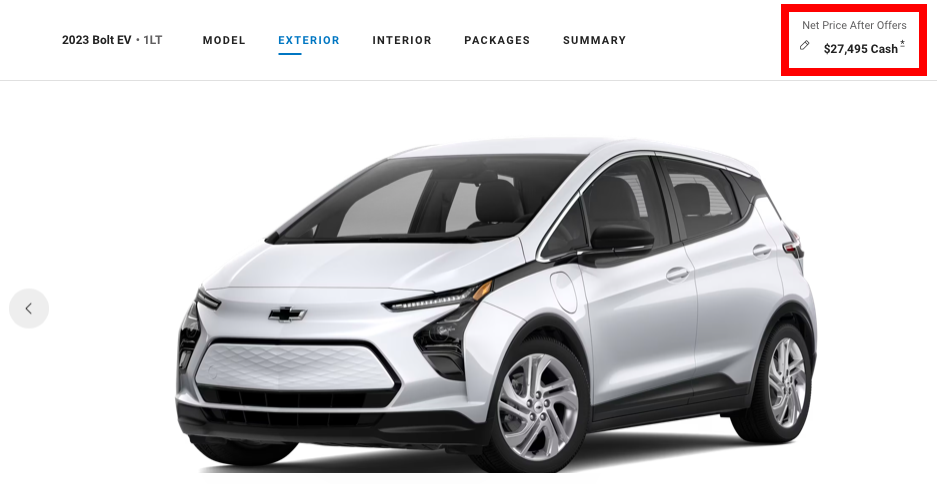

The Chevy Bolt EV starts at just $27,495+TT&L

It qualifies for the $7,500 EV income tax credit, reducing the effective price to $19,995 (more on this later. check the end of this post).

Did you get that???

$19,995 for a proven, American-made electric vehicle (if you don’t live in Texas).

According to the EPA, it has an MPGe of 120 MPG!!! To understand this better, let’s do a little math (I know, but it’s the way my brain works. I can’t help it.):

IF:

- You’re thinking of buying a new vehicle, and

- You have auto financing available at 8% APY, and

- You plan to finance your next car for 72 months, and

- You have a down payment or trade-in that pays the new vehicle’s TT&L, out of pocket, and

- You pay full MSRP for the Bolt EV, then:

*** Your monthly car payment would be $350.58 ***

BUT WAIT! THERE’S MORE:

IF:

- You drive 12,000 miles per year, and

- Gasoline costs $3.29 per gallon (U.S. average right now), and

- You can charge at home and pay 16.7¢ per kWh (U.S. average right now), and

- You usually pay $50 for an oil change and change oil 3 times a year, and

- You’re driving (or considering) a gasoline-powered car that gets 30 MPG, then:

You’d save:

$75.41 per month in fuel & oil costs, EFFECTIVELY REDUCING YOUR MONTHLY PAYMENT TO $275.17 PER MONTH.

To put that in perspective, THAT’S LIKE FINANCING A NEW GASOLINE-POWERED VEHICLE THAT COSTS $15,700 +TT&L.

***** Live in Texas? It gets even better: *****

If you can get the $2,500 Texas EV rebate (https://www.tceq.texas.gov/airquality/terp/ld.html) and use it to pay a portion of each month’s car payment, the EFFECTIVE MONTHLY PAYMENT IS $240.45 PER MONTH.

You read that right, an effective car payment of $240.45 per month for a vehicle that requires NO SCHEDULED MAINTENANCE for 150,000 miles (other than cabin air filter replacement and rotating the wheels for wear).

To put that in perspective, THAT’S LIKE FINANCING A NEW GASOLINE-POWERED VEHICLE THAT COSTS $13,700 +TT&L.

***** Here’s the most important thing you need to know: *****

To get the amount financed (and therefore, monthly payment) as low as possible, starting on January 1, 2024, the income tax credit CAN BE TAKEN AS A POINT-OF-SALE DISCOUNT, reducing your monthly payment, even if your tax burden cannot handle a $7,500 credit!!! (if the dealer signs up for the program with the federal government).

Most auto makers don’t allow a financial quarter to end on a weekend or holiday. THIS MEANS THAT THE LAST DAY FOR DEALERS OF 2023 IS JANUARY 2, 2024. Most car buyers know the absolute best time to buy a car is close to closing time on the last day of the year, because dealers are trying to hit their sales number which qualifies them for financial incentives from the manufacturer (and bragging rights). In other words, they’re much more willing to negotiate price at that time. Since the last day of the year is January 2nd (which is after the change to the federal EV tax credit) you could get the tax credit applied to the price of the car instead of waiting to get it back from the IRS, reducing your monthly payment.

My advice:

- Start shopping NOW.

- Ask the dealer if they’re going to participate in the government program to apply the tax credit to the sale price. If they aren’t, find another dealer.

- If they don’t know about the program, send them here: https://www.irs.gov/newsroom/topic-i-registering-a-dealerseller-seller-reporting-and-clean-vehicle-tax-credit-transfers

- KEEP AN EYE ON DEALER INVENTORY! Don’t let them sell out before you buy! If you can qualify for the EV tax credit, you may have to pull the trigger before January 2nd and apply the tax savings to your monthly payment yourself.

- If inventory levels allow it, buy on January 2, 2024.

- If in Texas, there’s a limited number of EV rebates, so file the paperwork as soon as you leave the dealership your new Bolt EV!

- If the Bolt EV isn’t your cup of tea, remember this same strategy exists for all EVs that qualify for the EV tax credit (https://www.fueleconomy.gov/feg/tax2023.shtml)